Value Investing

![]() A Proven, Risk-Averse Approach To Wealth Building

A Proven, Risk-Averse Approach To Wealth Building

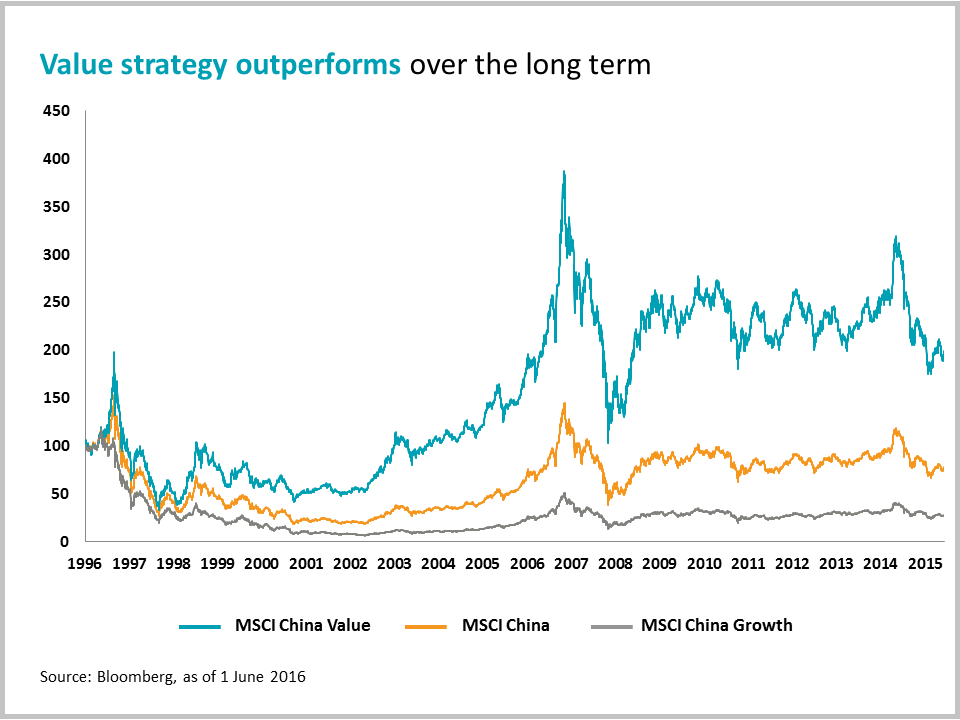

Value investing is the strategy of buying stocks that are priced below what their business fundamentals indicate they are worth on the conviction that their market value will appreciate in the long term. This approach to investing is founded on the belief that stocks tend to be mispriced by the market, as investors react irrationally and emotionally to what they see and hear. We believe this is the most effective investment style for the long run.

At Value Partners, we manage our clients’ wealth according to the traditional principles of value investing outlined by Professors Benjamin Graham and David Dodd in their classic book Securities Analysis. This means we take a risk-averse approach to investment management, based on developing a thorough understanding of the underlying business and looking for a high margin of safety.

What does it take to be a successful value investor?

![]() Research

Research

Our fund managers are business analysts first and foremost, spending much of their time visiting companies, meeting with their management face-to-face, and talking to their customers and suppliers in order to ensure each of our investment decisions is well informed.

![]() Discipline

Discipline

To excel in investment management requires a disciplined, consistent approach. Our fund managers never deviate from the value investing approach and avoid investing in market fads which can take away profits as fast as they are made. It is this uncompromising approach that has allowed Value Partners to steer clear of the fall-out from stock market bubbles in the past to deliver a top-ranked risk-adjusted performance.

![]() Courage

Courage

Value investing requires courage because the best value-driven investment opportunities are often found in little known stocks and out-of-favour business sectors. At Value Partners, we encourage our fund managers to be contrarian in their thinking and invest with the courage of their convictions.