2025 Gold Outlook | Discovering the Potential of Gold in 2025

04-02-2025

Gold price hit multiples record high in 2024, supported by geopolitical tensions and central banks buying demand, being one of the best-performing assets in the year. Will the gold’s bull run continues in 2025? Amid stronger-than-expected US dollars and high interest rates, we note that gold prices are more sensitive to structural demand and geopolitical risks than interest rate cuts. We forecast gold prices will continue to soar by the end of this year, extending its record-breaking price rally into 2025.

Central Bank Demand

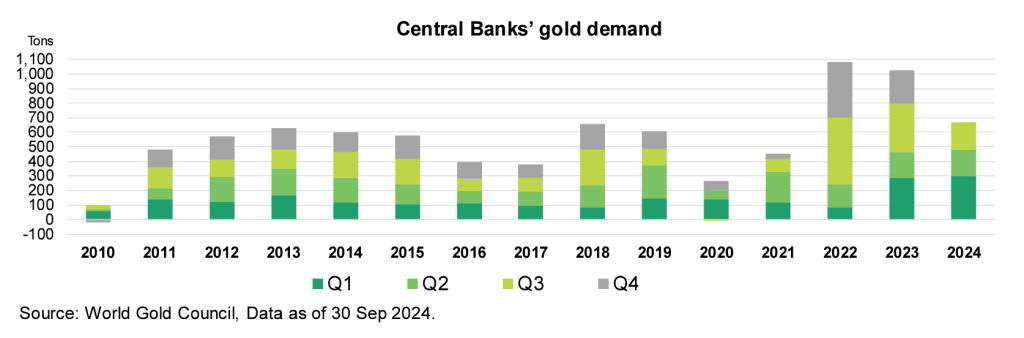

Figure 1: Support from global central banks

Central bank gold purchases have been a major catalyst for the current bull market, and this trend is expected to persist in 2025 as developing economy central banks continue diversifying their US dollar-heavy reserves. Major buyers like China, India, Russia and Poland have all ramped up their gold reserves in recent years, motivated by strategic considerations of de-dollarisation beyond just price fluctuations.

Between 2022-2024, central banks have collectively added over 2,700 tons of gold to their coffers, which is the fastest pace of accumulation in modern history (Figure 1). The importance of gold in foreign reserves is well recognized, with central banks viewing it as a long-term store of value, a diversifier, and an asset that performs well during crises and times of geopolitical uncertainty.

Ultimately, the relentless accumulation of gold by central banks, driven by strategic foreign exchange diversification goals, has been a crucial pillar underpinning the precious metal’s bull run. This trend appears poised to persist in 2025, providing a crucial backstop for gold prices even in the face of potential headwinds from a hawkish shift in US monetary policy.

Investment and Asian Consumer Demand

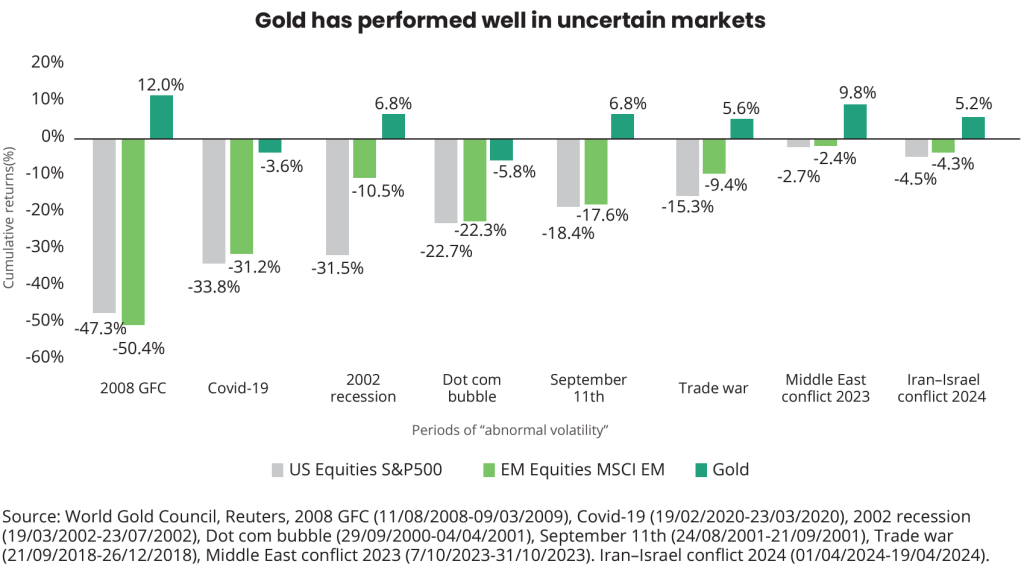

Figure 2: Diversify risk during market downturns

Investors have flocked to gold as a hedge against inflation, market volatility and economic uncertainty. Gold’s role as a proven portfolio diversifier will also sustain demand from institutional and individual investors looking to mitigate risks in times of market stress, especially during periods of “abnormal volatility” (Figure 2). Holdings of gold-backed ETFs surged to record highs in 2024 as portfolio managers sought to diversify their exposure. This investment demand is likely to continue in 2025 given the prospect of further interest rate cuts by the Federal Reserve and other central banks.

As the world’s growth engine, Asia’s voracious appetite for gold will be a critical pillar supporting the market in 2025 and beyond. Chinese and Indian consumers have historically been price-insensitive, viewing gold as a store of value and inheritance asset. Although the Chinese economy has been a key concern in the past few years, we expect 2025 Market Outlook that fiscal expansion, together with other targeted measures towards consumption, will come into effect in the coming quarters and support the economy. Even if short-term demand fluctuates with economic conditions, the structural drivers of gold consumption in these markets remain firmly intact. Regulatory changes in India also encourage gold investment via mutual funds and ETFs could also unlock new sources of consumption.

Trump 2.0

Figure 3: Gold has historically rallied in periods of high inflation

Trump administration’s policies of tax cuts, higher defense spending, and potential tariff hikes could widen the US budget deficit. This expansion of fiscal red ink, when paired with the Federal Reserve’s anticipated rate cuts, could create the type of dual tailwind that has historically boosted gold prices. Large and rising government debt burdens, when combined with dovish central bank policies, can significantly enhance the appeal of non-yielding assets like gold as a hedge. As the US national debt continues climbing, expected to surpass its GDP in 2025, this dynamic is likely to provide a powerful tailwind for gold prices in the year ahead.

Gold has historically rallied in periods of high inflation, and we believe this in turn should continue enhancing gold’s status as a core portfolio diversifier and hedge against inflation (Figure 3). With Trump’s administration threats to impose tariffs against different countries, we think it will potentially stoking inflationary pressures and exacerbating fiscal imbalances. This dynamic, combined with the Federal Reserve’s dovish tilt, could offset any headwinds the precious metal faces from a stronger US dollar or receding geopolitical tensions.

Potential Headwinds

A key risk factor is the possibility of a more hawkish pivot by the Federal Reserve, which could push real yields higher and strengthen the US dollar. If the US economy proves more resilient than expected, allowing the Fed to maintain a more hawkish policy stance, it would likely diminish gold’s relative attractiveness versus yielding assets. Similarly, a quicker cooling of inflation could reduce safe-haven inflows into gold as an inflation hedge.

While tensions around flashpoints like Taiwan, the Middle East and Eastern Europe have so far buoyed gold, a de-escalation or diplomatic breakthrough could remove some of this risk premium. However, the structural drivers of gold demand stemming from central bank diversification, investment portfolio allocations, and Asian consumer preferences appear robust enough to withstand intermittent bouts of dollar strength or reduced geopolitical fears.

Overall, the preponderance of evidence suggests that gold will continue to shine in 2025. Fueled by dovish global central banks’ policies, elevated geopolitical risks, and stubborn inflation, the yellow metal is poised to build on these gains in the year ahead. Robust investment flows, resilient Asian consumer demand, and relentless central bank purchases look set to offset any potential headwinds from a hawkish shift in US monetary policy. With the macroeconomic outlook clouded by recession risks and policy uncertainty, gold’s appeal as a safe-haven and inflation hedge should sustain its bull run into 2025 and beyond.

Know more about Value Gold ETF | 3081

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This article has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.