Policy Matters: More supportive measures came as expected – Anti-Covid and property policies update

29-11-2022

November has been a roller-coaster month for China investors. The initial market hype – stimulated by the fine-tuning measures to anti-Covid controls and supportive measures to the property market – has faded after a sharp rise in new Covid cases and increased disappointment on the relaxation at the local levels, leading to the market plummet on 28 November 2022. However, what came the day after on 29 November 2022 is another series of supportive measures announced by different government entities which have helped major China market indices to rebound quickly and recover losses.

Anti-Covid policy

29 November 2022, the National Health Commission (NHC) and other health administrations have jointly held a press briefing to address anti-Covid policies. While no major new measures were announced, the NHC has pledged to ramp up vaccination for the elderly and emphasized the prohibition of excessive control measures, including those lockdowns, which are deemed unnecessary. These are seemingly in response to the rising concerns about the back-and-forth easing of anti-Covid controls, especially in addressing the issues arising from “layer-by-layer” and “one-size-fits-all” at the local government levels.

In our view, an exit from the anti-Covid policy is a process that could take six-nine months to gradually and orderly implement. During the process, it could be a bumpy ride among different local governments to strike a balance between loosening measures and preventing mass outbreaks. The resurgence of Covid cases is likely due to the loosening measures, which in turn may also result in the short-term return of anti-Covid policy tightening, causing some social frustrations in China. However, we view that the positive policy developments remain intact as today’s announcement clearly suggests the policymakers in China are well-alerted to the social issues and the people’s concerns, and are committed to lifting economic growth and social activities back on the right track. This shall continue to inject further confidence into the market participants.

In a nutshell, we view that policy direction is very clear that it will continue to support Chinese markets, and economic growth remains the policymakers’ key priority. We suggest investors should focus on the long-term quality growth agenda set by the top government officials, despite the short-term volatility arising from the normalization process.

Property market policy

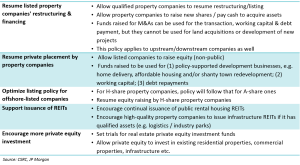

These supportive measures didn’t come as a surprise as we have indicated more efforts will come in the last “Policy Matters” (titled “Risk on” driven by policy pivoting, expect more to follow, published on 16 November 2022) after the 20th Party Congress. On the property side, the CSRC has just announced a five-point measure (see Exhibit 1 below) to support the equity financing of the property companies, which provided additional support to the sentiment of property developers and their affiliates. Although these measures seem to benefit SOE players and potentially facilitate their acquisitions through the means of equity financing, we view these – together with the enhanced bond financing and bank lending – should also ease the liquidity and funding pressures facing some privately-owned entities, hence restoring the healthiness of the overall ecosystem.

Exhibit 1: Summary of CSRC’s five-point measure on equity raising of property companies

Market implications in the credit market

The measures are in addition to the 16 measures jointly announced by PBoC and the CBIRC at the beginning of November, which focused more on bond financing and support from the banking channel. Together with the newly announced measures by the CSRC, the improvement in sentiment has triggered a strong rally in the bond market, given short and underweight covering, with some bond prices of credit names perceived as the “survivor” privately-owned developers rising more than 200 % in November. The iBoxx Asia ex-Japan China Real Estate High Yield Index was up 53% month-to-date as of 28 November 20221.

We believe that the actual impact on property developers could be limited, given that equity financing has always been a less important funding source. It is also important to note that these measures only impact A- and H-share listed companies. Still, many privately-owned (POE) developers were not under an H-share structure and hence were not supposed to be subject to the previous ban on new equity raising.

That said, we believe it is an important step in the right direction as this gives a strong signal to the market that the authorities are aligned (PBoC, CBIRC, and now CSRC) to streamline policies in support of selective POEs to ride through this period of tight liquidity. From a sentiment standpoint, this is positive, and it is reflected in the strong performance of those credit names.

As mentioned last time in our short commentary on the 16 measures, short-term momentum could continue to drive prices up, especially for the perceived survivors – which we hold across our credit strategies. We have also been adding back to the sector to capture the near-term rebound, although still in a cautious manner. Again, ultimately for a sustained recovery, fundamentals remain the most important, and hence we will continue to monitor various data, such as contracted sales, for confirmation. We would reiterate that the recovery process will likely take a long time, but we definitely are moving another step closer to the end of the tunnel.

Source:

1. Bloomberg, 28 November 2022

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.