China’s rapid reopening to support a firm economic recovery and further market upside

10-02-2023

What’s the immediate impact:

The speed of China’s policy changes and reopening has surpassed the expectations of many. With the effects of Covid disruptions quickly vanishing, business and economic activities are quickly picking up, as reflected in some data points gathered during the Chines New Year (CNY) holidays:

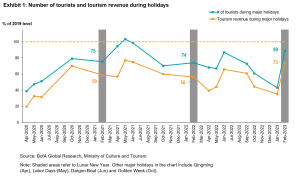

- Domestic travelers and spending were both up by more than 20% y-o-y during CNY, with each reaching 89% and 73% of the pre-Covid level in 2019, respectively (Exhibit 1), according to China’s Ministry of Culture and Tourism.

- Data from the Ministry of Commerce shows the sales of key businesses were up 6.8% y-o-y during the holidays, with the dining segment showing a strong recovery (up 15.4% y-o-y).

- Cinemas have also welcomed a stunning return of moviegoers, with the total box revenue rebounding to the second highest on record.

We believe the fast recovery of consumption activities has laid a strong foundation for economic rebound this year. In fact, the latest PMI readings released by the National Bureau of Statistics also suggest both the manufacturing PMI and the non-manufacturing PMI were back in the expansionary zone in January 2023, especially with a stellar reading in the services industries.

The spillover effects

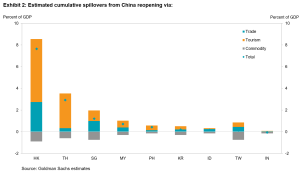

Other markets across Asia have also felt the effects of China’s reopening. During the CNY holidays, the return of mainland Chinese tourists hit the headlines of many newspapers across the region. Admittedly, the pace of the spillover effects is still much slower compared to the burgeoning domestic activities. Data from Goldman Sachs suggest that international air traffic is still tracking at around 10% of the pre-Covid level, although this is undeniably a great start. Meanwhile, the facilitation of international travelling will also drive the resumption of cross-border trading and business activities. This will likely create a material and positive impact on most Asian regions (mainly through the accretion to trade and tourism), especially in Hong Kong, Thailand, and Singapore (see Exhibit 2).

Recent market correction

Despite a faster-than-expected reopening, China’s stock markets have seen some volatility after the CNY holidays. This market correction is not unexpected, as we have been cautioning about short-term risks in recent publications in view of the weakening external demand and ongoing geopolitical tensions.

In particular, the most recent market correction can be attributed to two key market considerations:

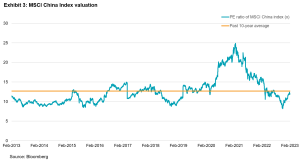

- China’s stock market valuations have returned to a more normalized level. For example, the MSCI China Index rebounded nearly 60% from its low at the end of October 2022. Its PE has risen to 12.4x prior to the CNY holidays – not far from its past 10-year average of 12.7x (see Exhibit 3).

- The strong and undifferentiated stock market rally in the last three months was mainly driven by a “sentiment relief”, yet it takes time for fundamental recovery to play out and for corporate earnings growth to come back.

Ongoing geopolitical tensions

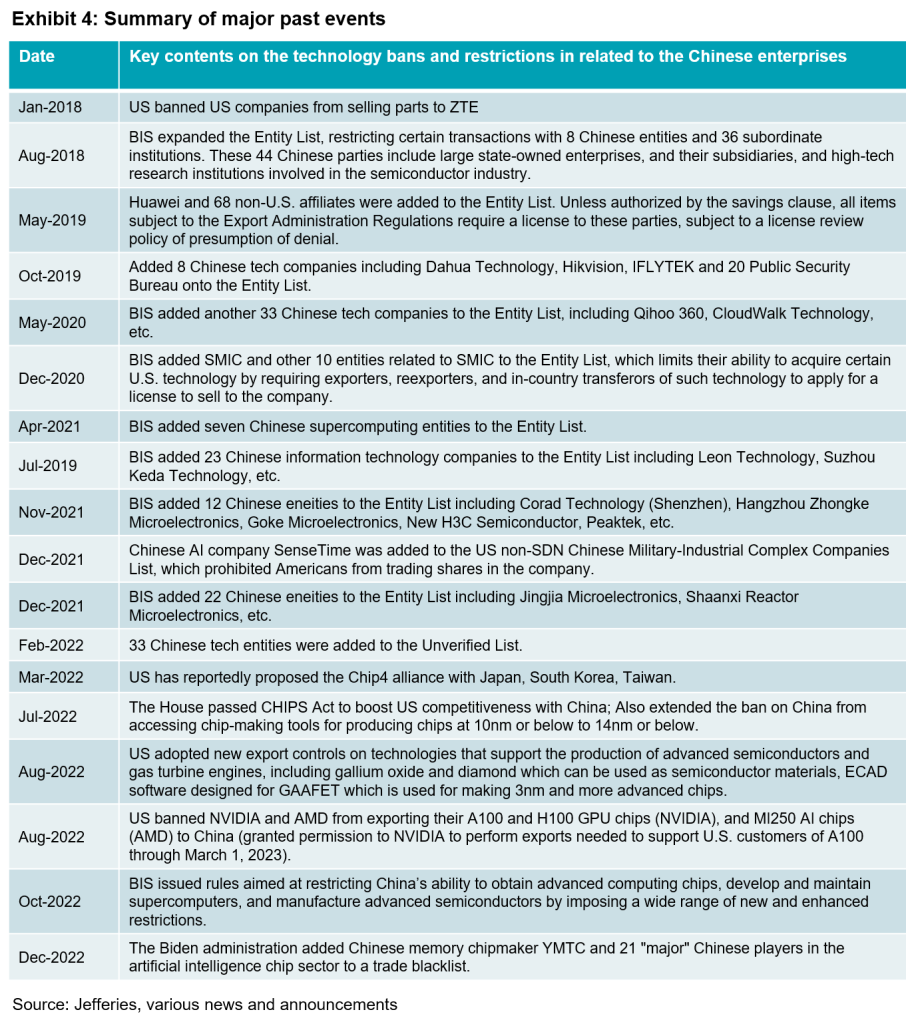

The recent weakened investors’ sentiment may also be partly driven by the rising geopolitical tensions, especially those related to the additional technology restrictions that the US may impose on Chinese companies. A Politico report published on 27 January 2023 said the Biden administration may consider a full-fledged ban on US investments in China’s high-end technology sectors like AI, 5G, and quantum computing. While the report, which cited a US congressman, is unconfirmed, it still represents a clear reminder of the ongoing dispute between the two nations (see Exhibit 4 for a summary of major past events).

That said, it is currently difficult to assess the actual impact of any new restrictions. In particular, it is unclear whether any new restrictions (if the report were to be confirmed) will be only limited to direct investments. It is also unclear to what extent this may deteriorate the bilateral relationship (bear in mind many other forces are also in the play). However, one thing for sure is any further escalation in technology-related restrictions will only reinforce China’s plan to achieve its “self-sufficiency” goals in key technology areas and could potentially spur more government-directed support and investments into certain key industries.

Stay positive

Despite the recent market correction and the external headwinds, we remain constructive about China’s market outlook in 2023 and see further upside at the current valuation levels. After all, China is one of the few major economies that is expected to record a material GDP growth rebound in 2023. In the meantime, top policymakers have repeatedly stated that economic growth is a priority and reiterated the support of the platform economy and private enterprises. We expect more policy stimulus will be unveiled, perhaps after the upcoming “two sessions” in March 2023.

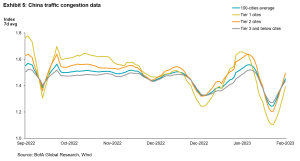

However, it is also worth highlighting that the economic and business recovery was uneven across different sectors and regions. Congestion data indicate that business activities have picked up faster in lower-tier cities than in tier-1 ones. Meanwhile, property sales have remained relatively weak and other companies are releasing mixed operating trends. For investors, we believe the focus should now shift from the pace of reopening to the quality of recovery (including the actual delivery of earnings growth and its sustainability). In our view, it is crucial to remain selective and to stick with high-quality players with solid business franchises, strong competitive moats, and visible earnings growth momentum.

In a nutshell, despite short-term volatility, we remain optimistic about China’s stock market outlook but believe it is important to be selective. Our strategies remain well-positioned to capture the strengthening growth prospects of quality Chinese companies, especially those related to technology advancement, the growing domestic wealth management segment, and consumption growth.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.