Is it time for a rebound in China property credits?

25-01-2022

With growth stability as the key policy agenda for China in 2022, we are seeing more signals from the government that it has been giving more signs that it is taking a more pro-growth policy approach. Just last week, the interest rate for the medium-term lending facility (MLF) operation has been lowered by 10 basis points (bps), the first time since April 2020 and about a month after it cut the reserve requirement ratio (RRR) in December. Furthermore, the one-year and five-year Chinese loan market quoted rates (LPR) have also been lowered last week:

- 1-year LPR down by 10 bps to 3.7%1

- 5-year LPR (the benchmark for mortgage interest rates) falls 5 bps to 4.6%1 (the first cut in 21 months).

The intensified counter-cyclical regulation of monetary policy reflects the pre-emptive direction of macro policies. Furthermore, we also see China formulating more measures to stabilize the real estate sector.

According to recent reports, under the guidance of the Financial Stability and Development Committee of the State Council, the Ministry of Housing and Urban-Rural Development, which is the sector’s main regulator, and other authorities are drafting new rules to potentially relax developers’ use of funds in pre-sale escrow accounts to assist in timely project delivery, payments to suppliers, and outstanding financings2.

These measures aim to ease liquidity stress and prevent a financial contagion in the real estate industry. The new regulations are expected to be launched as soon as the end of January, and the news has triggered a sharp increase of 10-20% in high-quality developers bonds last week.

We believe this new round of relaxation will bring some breathing space for developers. The market is now also expecting more favorable policies that might be introduced in the next few months. In conjunction with the lowering of mortgage loan interest rates, it is expected that the industry outlook may bottom out, positioning China property credits for a rebound and improving their performance this year.

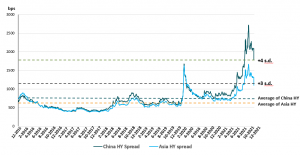

China high yield credit spreads at 4 standard deviations cheaper over the last 5 years

Source: Bloomberg, ICE BOFA, Value Partners, as at 31 December 2021

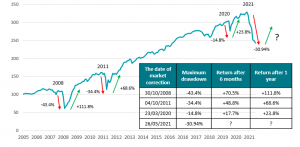

Historically, the China high yield bond market may provide compelling return after market corrections

Source: Bloomberg, UBS, Value Partners, as at 31 December 2021

Overall, we believe there are increasing positive signals for China high yield investors. The new policies introduced recently by the authorities signal potential further relaxation in the near future, further boosting investor confidence in the market.

For the past six months, Value Partners has been moving up the quality spectrum of China high yield bonds. With the view of recent market turbulence in China’s property sector, we have focused on selected companies with relatively manageable debt levels in the market and companies that proactively obey the Three Red Lines policy. We believe real estate developers with stable capital and cash flows will most likely benefit from any future market rebound.

Lastly, although volatility is expected to remain elevated, we believe the current dislocation will provide opportunities in the medium to long-term but will require investors’ patience.

Source:

1.The PBOC, 20 January 2022

2.Bloomberg, SCMP, 19 January 2022

Read More:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.