Policy Matters: CEWC injects further confidence to the economic growth outlook in 2023

19-12-2022

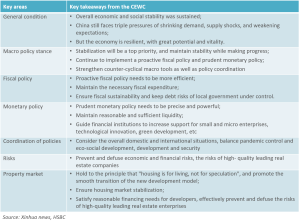

The much-anticipated Central Economic Working Conference (CEWC) of China was concluded in Beijing on 16 December 2022. While no specific GDP growth target for 2023 was being disclosed, the CEWC still sent a clear message that China’s top policymakers are now prioritizing on the economic growth: on one hand, the meeting has recognized three significant headwinds facing the economy (i.e., demand contraction, supply shock and weakening expectation), which are largely reflected in the weak November activities data; on the other hand, and in echoing with the Politburo meeting that being recently held, the CEWC has pledged to “vigorously boosting market confidence” and “promoting the overall improvement of economic performance” in 2023. Please turn to the overleaf for more takeaways on the conference.

The CEWC also outlined some concrete directions and policy initiatives related to reenergizing economic growth, including:

- Continue to optimize the anti-COVID controls and facilitate the transitional period. This seems to suggest the recent fine-tuning measures (such as the ten new measures that were announced by the National Health Commission) – despite also ostensibly leading to a rise in new cases – will not be reversed.

- Expand the domestic consumption demand. Consumption was being placed at a high priority and this, when reading in conjuncture with the recently-announced strategic outline (2022-2035) to expand domestic consumption, seem to suggest more supportive measures are likely to roll out. In particularly, the CEWC specifically mentioned to support the demand on housing improvement, new energy vehicle and elderly services.

- Support the platform enterprises to contribute more in leading the developments, job creation and international competition. This reaffirms our view that the government’s regulatory stance toward the internet companies has turned from restrictive to supportive. Separately, it is also worth noting that, on 15 December 2022, the Public Company Accounting Oversight Board (PCAOB) also announced that it has secured the complete access to inspect and investigate Chinese audit firms, essentially reducing the near-term risks of ADR-delisting.

- Ensure the smooth development of the real estate market. Despite maintaining the rhetoric of “housing is for living and not for speculation”, the CEWC also made it clear about supporting the demand for improvement houses and to promote M&A within the industry. Also recall that Vice Premier Liu He, in a separate speech, characterized the real estate sector as a “pillar industry”. Hence it is expected that more supportive measures will be launched to support the real estate market.

Overall, we believe the CEWC represented an important avenue for the top policymakers to showcase their commitment to drive stronger economic recovery ahead. Following the miss of its GDP target this year, we believe China is well positioned to become one of the few major economies to register a faster GDP growth next year, which will in turn support a faster corporate earnings recovery. Overall, we remain optimistic about China’s stock market outlook in 2023 and expect more supportive measures to be announced in the coming few months. Our strategies are also well positioned to capture the strengthening growth prospects of the quality Chinese companies, especially in relation to the themes of technology advancement, wealth management business growth and consumption growth.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.