Fixed Income Outlook 4Q 2021

09-11-2021

Distorted valuations but be selective

Inflation expectations in the driving seat

The third quarter of 2021 was characterized by further growth normalization as fiscal stimulus and low base effect faded away. Global inflation, however, remains to be the dominating theme in the coming quarters, driven by ongoing supply chain constraints and high energy prices. Rising vaccination rates releasing pent-up demand and potential wage gains in the US could accelerate inflation worries. We expect that the supply chain issue may be resolved in 2022, which may alleviate some of these inflationary pressures. Markets would therefore likely maintain the expectation for a very gradual Fed hiking cycle. There are scopes for the 10-year US Treasury yield, which is c1.5%, to nudge a tad higher by the end of 2021, but we see the magnitude nowhere close to the extreme move in March 2021. Despite tighter financial conditions in the US, ample liquidity and sizable negative yielding bonds (US$ 11.7 trillion) globally would continue to lure demand for yield enhancing assets.

China policies take the spotlight

In China, policy drove much of the volatility in the third quarter, which was in line with expectations in our last quarter outlook. With the government’s priority on controlling financial risks and leverage, credit growth would remain subdued. Nonetheless, we expect that credit contraction is bottoming and some marginal rebound should occur in the coming quarters. Slower growth momentum and People’s Bank of China’s (“PBOC”) keen maintenance on liquidity should limit 10-year Chinese government bond (“CGB”) yields, currently at 2.9%, to materially rise. Moreover, persistent foreign inflows into onshore bond market and strong trade export should mitigate cyclical headwinds for the renminbi, which should bode well for the Asia dollar bond market.

The recent PBOC narratives downplaying the concerns on inflation and the use of other monetary measures to maintain stable liquidity has diminished hopes for further Required Reserve Ratio (“RRR”) cuts. Specifically for the property sector, with more failed land auctions and cooling property sales, the PBOC guided banks to resume giving out mortgages in several cities and provide loans to ensure a healthy state of the sector. On the other hand, the Ministry of Housing and Urban-Rural Development (“MOHURD”) is said to be drafting rules to strengthen supervision on developers’ presale funds – which could impair their financial flexibility, in our view. The potential launch of nationwide property tax may further affect sentiment. Overall, we believe the government will keep a tight stance with some marginal adjustments to avoid a material spillover effect from the Evergrande fallout and any systemic risks. The market may look up to the next Politburo meeting in early November for any clue on further policy easing.

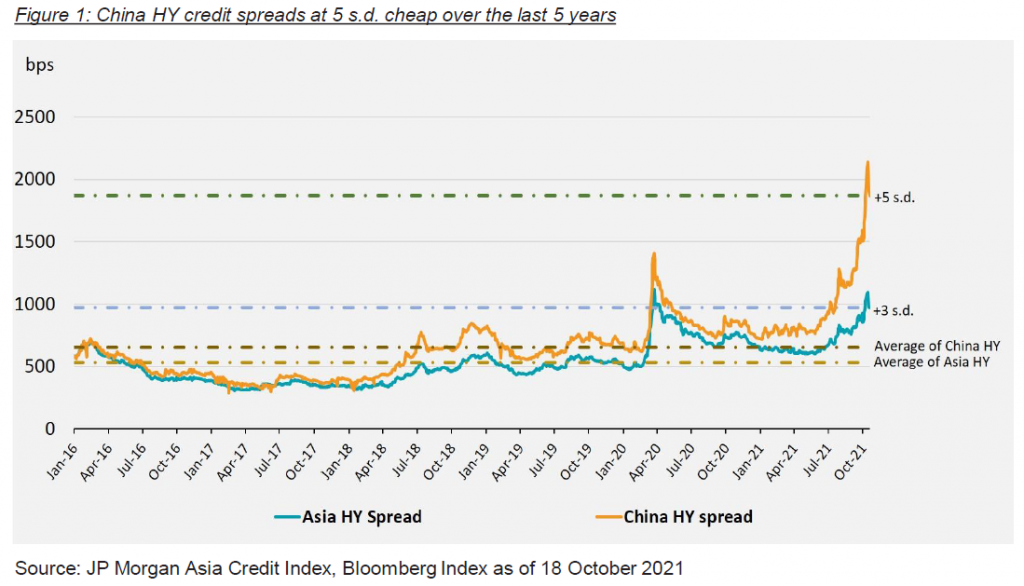

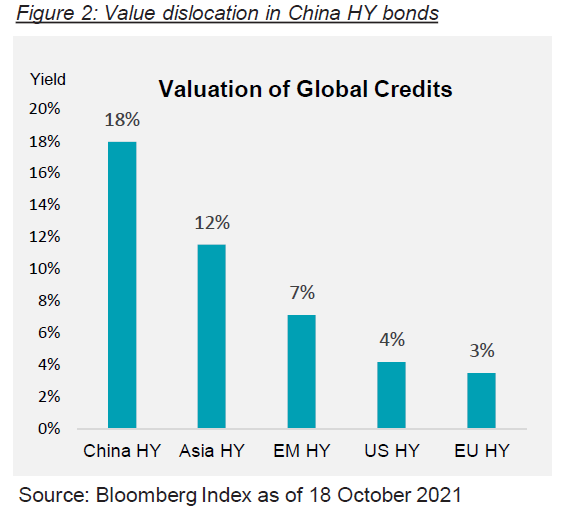

As policy and idiosyncratic risks are likely to stay on the horizon, we remain focused on credit quality for the rest of 2021. Asia’s economic recovery remains intact as pandemic threats are abating. As rising US Treasury rates remain a pressure point for Asia investment grade (“Asia IG”), especially when credit spreads are tight, shorter duration is preferred. China high yield (“China HY”) credit spreads stood at 5 standard deviation (s.d.) cheap over the last five years (Figure 1), indicating that a lot of the policy risks and sector consolidation have been priced in. Through our active management and bottom-up approach, we focus on searching for candidates that are long-term “survivors” but dislocated in terms of valuations (Figure 2). We believe they offer compelling value within the emerging markets space. As the Chinese property sector is undergoing consolidation with leverage control, this should anchor their credit profiles in the longer run.

>> Download the full report

Featured fund:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.