Rapid Opinion: Not there yet, but we are getting closer

03-11-2022

The market was desperately hoping for the US Federal Reserve (the US Fed) to pivot, but those hopes faded as chairman Powell delivered hawkish messages in Fed’s most recent press conference: “It is very premature, in my view, to think about or be talking about pausing our rate hikes.”

We are not surprised, as we have highlighted in our Think Piece <<When Powell turns to Volcker, you should turn to Value>>, published in September, that Powell will “keep at it” until it is done – i.e. when inflation falls back to an acceptable level. Powell also mentioned that the risk of running a loose monetary policy and entrenched inflation far outweighs the risk of restrictive monetary policy, as the Fed has effective tools to support the economy should policy become too tight. The clear bias towards over-tightening confirms again our view that the Fed is unlikely to pause in the near term.

So are we there yet? We believe there is still some way to go, but we are getting closer. Currently, inflation remains at 8.2%, which is way beyond the Fed’s 2% target. However, there are a couple of signs that make us believe that we are moving closer to the mark:

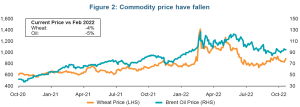

- Headline inflation – One of the causes of inflation was the supply-chain bottleneck that resulted in elevated goods prices: that is no longer an issue. The WCI Composite Container Freight Benchmark Rate has come down by 66%, following its peak in Q4 2021(Figure 1). Similarly, commodity prices have softened, with the growth of the UN food price index moderating to 5% from 30% a year ago(Figure 2). In addition, oil prices have stabilized despite the production cut from OPEC+. All these are going to translate into lower inflationary pressures for headline inflation.

Figure 1: WCI Composite Container Freight Benchmark Rate

Source: Drewry, 31 October 2022

Figure 2: Commodity price have fallen

Source: Bloomberg, 31 October 2022

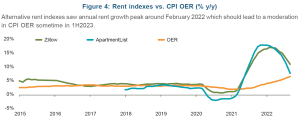

- Core inflation – While ADP jobs and wages data remained supportive, they were concentrated in the services sectors, which are still catching up on demand resurgence following the Covid-shock. Looking under the hood, other parts of the economy, such as manufacturing, have seen job losses. The latest data have also shown that the total number of job postings in the US has started to come down(Figure 3). Meanwhile, for shelter costs, the calculation of owners’ equivalent rent (OER), which is one of the key measures of how CPI incorporates rental costs, is by nature, lagging, and more incidental housing data, such as those on Zillow and Apartment List, have seen a significant drop too(Figure 4). All these are likely to take pressure off core inflation in the coming quarters too.

Figure 3: Total US job postings

Source: Revelio labs, 31 October 2022

Figure 4: Rent indexes vs. CPI OER (% y/y)

Source: BLS, Haver Analytics, Zillow, ApartmentList, BofA Global Research, 31 October 202

With base effect, we believe that a more substantial moderation of inflation could potentially happen sometime in the first half of 2023 (barring any other unforeseeable event, such as further supply shocks on the commodity complex). By then, there may be more room for us to see a more dovish Powell.

Having said the above, we note that in the Federal Open Market Committee’s (FOMC) statement, there is some new language that mentions the lagging effect of monetary policy: “Taking into account cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This may create an option for the FOMC to move away from its current aggressive policy direction, even if inflation has not yet achieved the 2% target. Indeed, we are getting closer, but before that, don’t unbuckle yet and keep your seatbelt fastened.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.