Takeaways from China’s NPC 2022

17-03-2022

China’s National People’s Congress (NPC) kicked off its annual gathering in Beijing on 5 March 2022. The government has set its target GDP growth to be around 5.5% in 2022 with a CPI target of around 3%1.

The growth target is on the high end of the market expectation range and more stimulus was announced to achieve economic growth stability. Key statements include:

- Fiscal deficit at around -2.8% of GDP (vs. -3.2% in 2021) 1

- Creation of more than 11 million jobs and ensuring urban unemployment rate to below 5.5%1

- The growth engine of infrastructure investments is confirmed

- RMB2.5trn of tax refunds1 and cuts for small businesses and self-employed

- R&D tax rebate for SMEs raised to 100% (from 75%)1

Unleashing the fiscal package

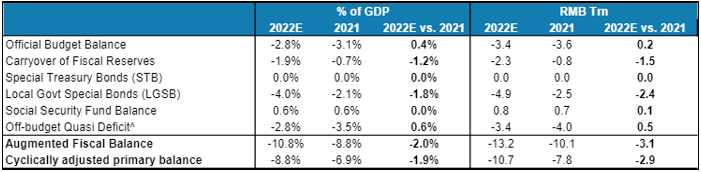

While fiscal support may appear relatively soft, it may be punchier than the headline figures suggests, as the augmented fiscal deficit would widen due to a larger deployment of unused fiscal funds from last year.

In addition, the government expenditure will actually increase by over RMB2 trillion, 8% yoy growth vs. 0.3% in 2021 and 2.8% in 20201. Within the spending, infrastructure spending is expected to grow 4.9%, vs. 1.7% in 20211.

Combined with the local government special bonds deployment, infrastructure investment is expected to accelerate. The total amount of tax cuts and fee reductions are also more than doubled from last year’s stimulus, which will surprisingly go to SMEs, high-end manufacturing companies, and green development, in line with the government’s previous stance to support these targeted sectors.

Source: 2022 Fiscal Budget Report, E= Morgan Stanley Research Estimates. ^Including land sales and LGFV funding.

Monetary policy is staying accommodative

Premier Li mentioned expanding the size of new lending, as well as reducing real loan rates and financial fees. The PBoC is likely to stay on the path of easing with further RRR reduction and re-lending tools to provide continued liquidity support.

Stabilizing the property market

The Chinese government’s stance around property policy re-iterated the message that housing is not for speculation. That said, contrary to last year, the tone is more constructive in 2022, as it encouraged various local governments to customize property policies based on local situations to better meet the reasonable demand of home buyers. Since January, 15 cities have relaxed home purchase restrictions. We believe more local level relaxation is likely in the pipeline, and the overall financing conditions for the property sector should see improvement in the months ahead.

Implication to China equity markets

The set target of around 5.5% economic growth, the frontloading of fiscal stimulus, and supportive policies reaffirmed the government’s stance to stabilize economic growth in 2022, setting a favorable backdrop for Chinese equities. The government has also stepped up the support for SMEs, to stabilize the job and property market and to restore consumption, boding well for our positions within the consumption sector. Fiscal supports also continue to provide strong incentives for innovation and industrial upgrading, extending its supportive stance from the Five Year Plan.

History suggests these pro-growth moves will take several months to take effect and shall lift market sentiment towards the China market eventually. Overall, as geopolitical tensions take the center stage, we are cautious in the near term but expect value to emerge as soon as geopolitical tension is eased.

Source:

1. NPC, 2022 Fiscal Budget Report, Morgan Stanley Research estimates

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions The information provided does not constitute investment advice and it should not be relied on as such All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed This material contains certain statements that may be deemed forward looking statements Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong Issuer Value Partners Hong Kong Limited.