The Multi-Asset Perspective: September 2020

14-09-2020

We spot two forces that draw capital in and out Asian markets – Investors are wary of the economic recovery in some countries, such as India and Southeast Asia, while the dovish Federal Reserve propelled the USD to enter a structural weakening cycle; Asian currencies will continue to strengthen, eventually attracting capital inflows to the assets.

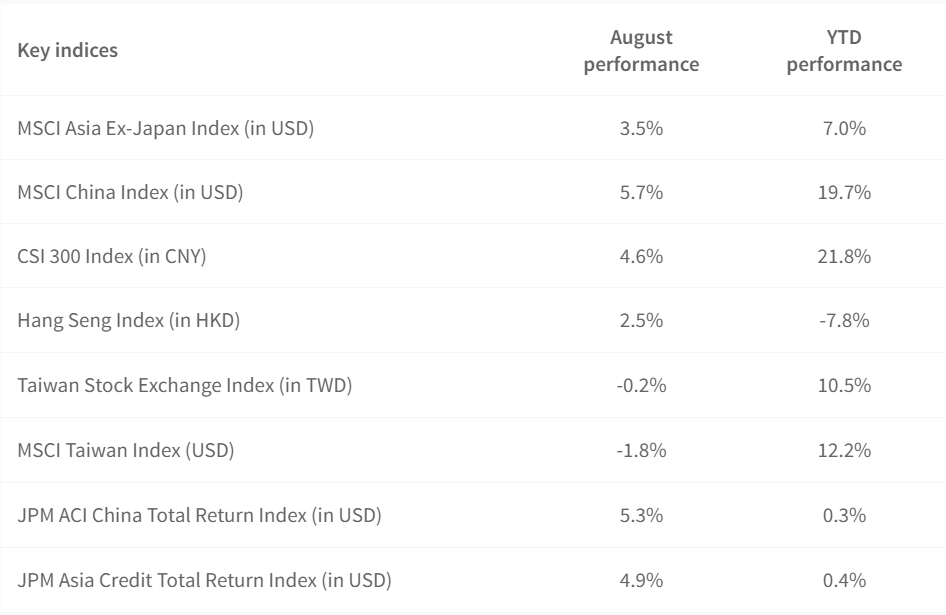

Source: J.P. Morgan, MSCI, Morningstar, Data as of 31 August 2020

China / Hong Kong Equities

- China’s macro indicators continue to suggest that the economic recovery is on track

- Earnings among Greater China corporates turned positive, with many beating the consensus for quarterly results. Increasingly, companies receive upgraded earnings forecasts from analysts

- The U.S. yield curve steepens and the expectation of inflation’s comeback heats up after the Federal Reserve reaffirmed its dovish stance. The rhetoric of a rotation to value also arises in the market

- Hong Kong equity’s attractive valuation would keep the market more resilient than the more high-priced markets

- The escalating Sino-U.S. tension is the most significant risk weighing on market sentiments

China A-Shares

- With the government bond yields continue rising, liquidity has tightened recently

- Investors have become more cautious on the A-shares market, given the huge run year-to-date

- The stronger RMB against the weakening USD would lend support to the market

Asia ex-Japan Equities

- Foreign capital still hesitates to flow back to Asia as investors are wary of the economic recovery in some economies, such as India and Southeast Asia. The former posts the second-highest number of the COVID-19 cases in the world after the U.S, while the latter lacks a progress to resume to regular economic activities. In August, Indonesia, Malaysia, the Philippines and Thailand extended their respective pandemic curbs

- The U.S. administration further restricted Huawei Technologies from obtaining foreign-made commoditized semiconductor components. That means, integrated circuit design houses in Taiwan are required to get the U.S. approval before shipping to Huawei onwards. The government remains confidence that export volume would stay solid and stable under the robust demand from remote working and learning in the rest of 2020, providing a full-year export performance projection of being flat year-on-year

- Analysts continue to upgrade the earnings forecast, especially for North Asian companies

- With the USD’s structural weakening trend under the dovish Federal Reserve, Asian currencies will continue to strengthen in the longer term, eventually attracting capital

Emerging Market ex-Asia Equities

- After some good run in oil and industrial metal prices, they started to reverse technically. EM ex-Asia markets will also be subject to some reversal as they are sensitive to commodity prices

- The widening of EM credit spread with rising bond yields indicates some correction heading to the region

- A structural weakening USD will lend support to EM ex-Asia markets over the longer term

Japanese Equities

- The lack of improvement in the economy and fundamentals is worrying

- The resignation of Prime Minister Shinzo Abe adds uncertainties to the policy direction as we advance, yet a significant shift away from Abenomics is unlikely

Asia Investment Grade Bonds

- With the yield curve starting to steepen with rising inflation expectation, a near-term correction is likely after such a strong rally

- The credit widening in the EM may also extend to Asian credits

Asia High Yield Bonds

- The stronger earnings sentiment in the region will continue to lend support to Asia high yield bonds

- The steepening yield curve starting and rising inflation expectation may lead to a near-term correction after such a strong rally

Emerging Market Debt

- Oil and industrial metal prices started to reverse technically after some good runs

- Credit spread in EM bonds has already begun to widen. Russia CDS is also getting higher

Gold

- Gold has been a good hedge against uncertainties. The massive monetary easing and fiscal deficit will be adverse to the USD and reflationary in the longer term, supporting gold demand

- With the yield curve steepening and the skewed sentiment and positioning in Gold, it will undergo a consolidation phase in the near term

Multi-asset

- Multi-asset offers a lower volatility level compared to a traditional single asset or a balanced portfolio

- The correlation between risk-assets, such as equities, credits, and commodities, has increased dramatically recently

- In an uncertain environment with low yields, income becomes an essential source of return for investors

The author is Kelly Chung, our Senior Fund Manager.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.