Homegrown players rewire supply and demand

02-02-2021

China’s first-in, first-out case ensured its supply to the world undisturbed, enabling the country to take market share from others. Even better, this is without the help of a significant government stimulus. Such a trajectory makes it the only major economy that showed growth last year. Next to COVID, de-globalization is another issue that China is facing. But China adapts and adjusts to the reality very quickly by refocusing on its domestic market. The market thus emerges a slew of domestic players from where we see investment potential for the next decade or so.

Reforming the Education industry – From online to tertiary schools

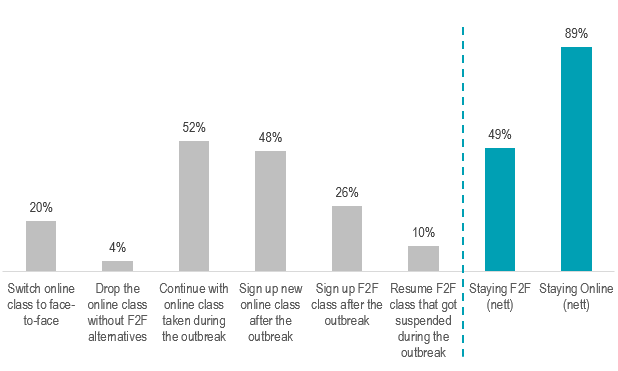

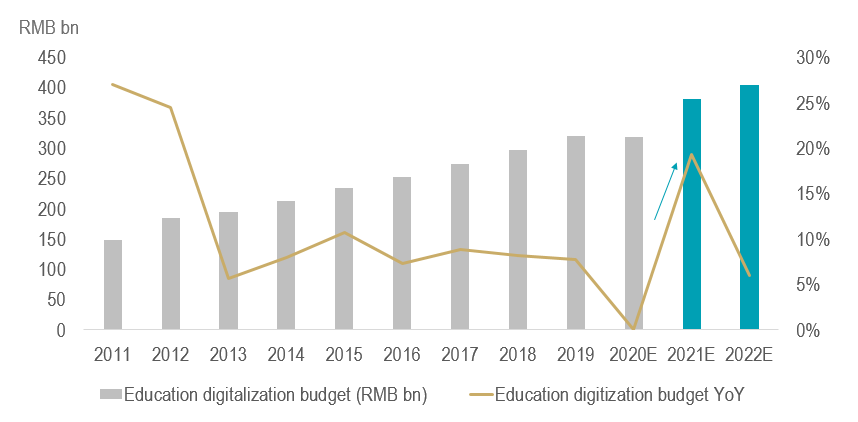

China’s system of kindergarten to 12th grade (K-12) education faces a slew of factors that would enable the industry to thrive. First, the willingness to sign up for online courses among students has not dimmed (Figure 1) despite a partial reopening of offline teaching. Next, the online operators are supported by the accelerated digitalization triggered by the pandemic norms. The environment remains favorable as the official budget to bring teaching and learning online is expected to touch RMB400 billion by 2022 (Figure 2), about 25% increase from 2019.

Figure 1: A majority of parents continued to sign up for online courses post-COVID

Source: Morgan Stanley Research. Note: Do not sum to 100% as multiple answers are allowed.

Figure 2: The Chinese government commits abundant resources to digitalize the education system, which brighten the outlook of online tutoring operators

Source: Morgan Stanley Research

Lastly, China’s 14th Five-Year Plan also looks set to harmonize teaching quality and delivers comparable learning outcomes between urban and rural communities via online education.

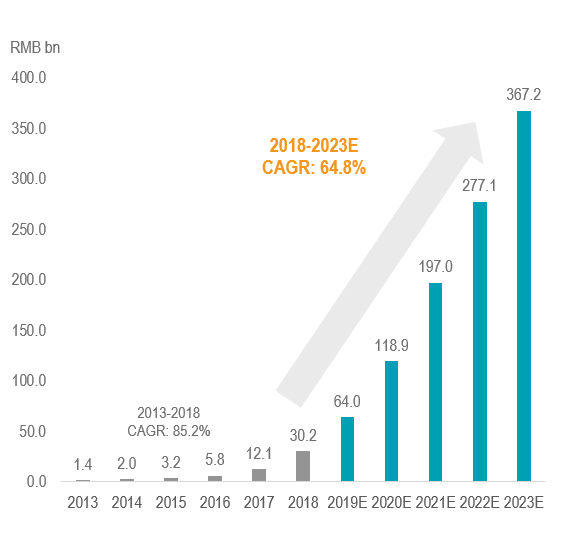

Furthermore, the general rate of attending K-12 after-school tutoring stands below the 30% mark1, while the penetration of the online tutoring industry is less than 20%, implying an ample room for development. The low penetration would buoy the users on the tutoring platforms (Figure 3).

Figure 3: China’s online K-12 after school tutoring market looks set to enjoy an exponential growth rate in gross billing terms

Source: Frost & Sullivan, Macquarie Research, November 2020

In our stock-picking, we prefer the front-runners that outstand with extensive pedagogic research, advanced application of artificial intelligence technology and effective tutor management. These established competitive advantages are likely to keep a considerable distance between leaders and laggards.

In the other corner of the market, our observation on imbalanced demand and supply of tertiary education remains unchanged. China’s central government has a long-term agenda to ramp up self-sufficiency and move up the value chain. This ambition implies a growing crave for educated and skilled workers, pointing to robust demand for an advanced and sound tertiary and vocational education system.

In 2019, some 9.5 million candidates2 sit for the National College Entrance Examination, the Gaokao, but only 7.5 million of them find places in tertiary education, creating a supply gap for the remaining two million without places. Penetration of higher education in China is still at an early stage but set to grow markedly. China’s gross university enrolment rate is currently at 52%3, compared to 93% in the U.S. The Chinese government has set a target to lift the rate to 65% by 2035.

Currently, the market of mainland education players remains highly fragmented, indicating the availability of merger and acquisition opportunities. Smaller private universities and colleges in China might well be prepared to share their ownership stakes with more scalable players to benefit from economies of scale. Considering all these factors, we believe Chinese higher education has significant potential to be a source of solid income growth in the future.

Reforming the Technology industry – Advanced hardware

As mentioned in the Preface, China’s dual circulation emphasizes internal circulation with a focus on increasing self- sufficiency and industrial upgrade. Domestically, technological hardware continues to be at the heart of China’s economic development. We believe the sustained commitment in developing maiden technology inventions would be necessary to build the self-dependent economic model.

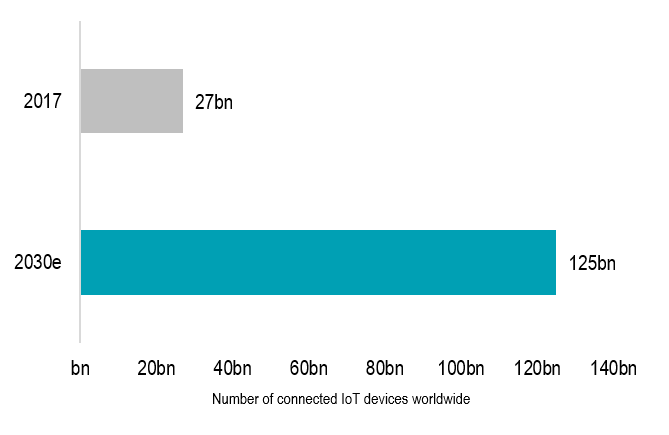

The sector relating to the Internet of Things (IoT) breaks the ground not long ago and investment demand for a new cohort of related infrastructure looks set to increase (Figure 4).

Figure 4: Internet of Things devices will see an exponential growth by 2030

Source: IHS Markit

In our view, the IoT driven era would open wide the growth avenues, meaning sustainable earnings headroom for respective value chain. For instance, IoT comprises of individuals, corporate and industrial applications. Compatible software, accessories and systems are necessary to enable the gadgets, also leading to value-added content such as new forms of entertainment, consumption, transportation, smart city infrastructure and finance. The application of IoT devices also unlocks a new era of manufacturing, such as industrial-use automation, which allows a wider range of customization and smarter production processes.

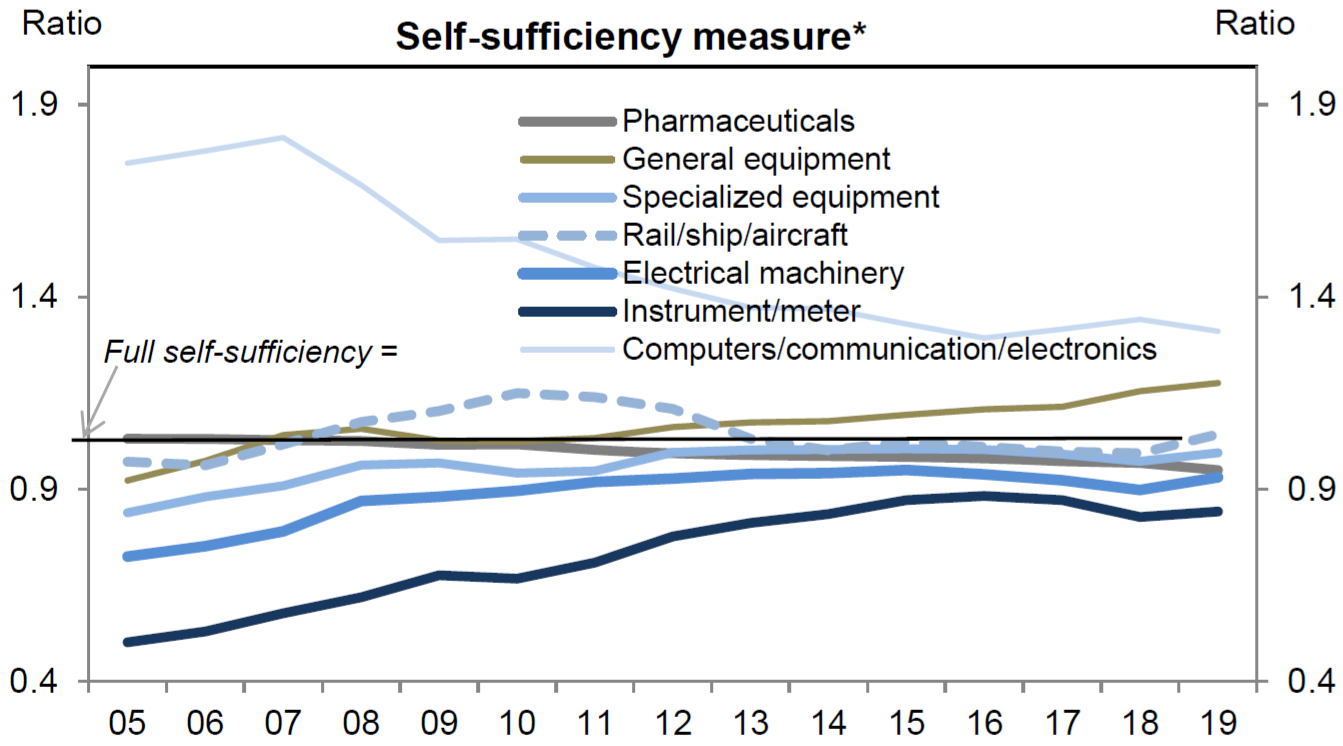

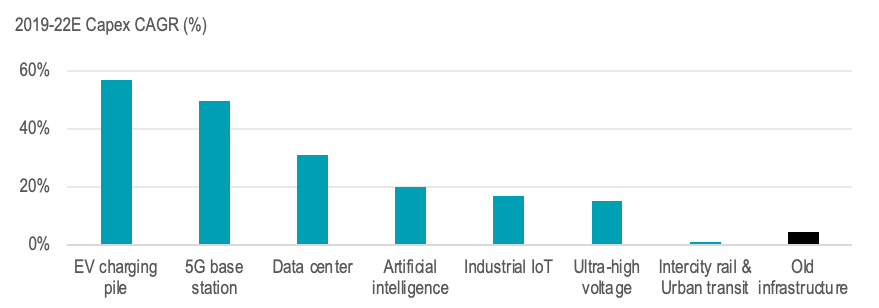

In addition to the increasing adoption of IoT applications, policy is the clincher. The general direction of China’s FYP has provided critical information on domestic industrial and innovation upgrades – the officials will have to commit substantial monetary and non-monetary support to help lift the low self-reliance (Figure 5) and drive increasing capital expenditure in various new infrastructures (Figure 6).

Figure 5: China’s self-sufficiency rate has room to catch up, in particular in the advanced tech areas

Source: WIND, Goldman Sachs Global Investment Research, November 2020. *Ratio of domestic production to domestic demand

Figure 6: China is on the way to an era of building new infrastructure, wherein growth is far more exciting than old infrastructure

Source: WIND, Goldman Sachs Global Investment Research, November 2020

Reforming the Healthcare industry – Unshaken long-term demand

The ongoing shifts in China healthcare sector, such as demographics transition, regulatory revamp and sector consolidation, remain relevant.

Firstly, China’s over-65 population is projected to reach 310 million by 2050 and account for 23% of the population4. By then, China’s enormous elderly population is estimated to exceed those of the U.S., Japan and Europe combined. The aging population’s incremental demand would need a robust healthcare system and improved access to affordable yet quality drugs. Despite the growing needs, Chinese nationals’ medical expenditure is still far behind other advanced economies, totaling a mere 6.4% of GDP5. This is compared to 17% in the U.S. and 12% in Japan and Germany.

Second, to command a better public health system, Chinese authorities have renewed some regulations that have triggered sector consolidation. For example, several rounds of bulk purchases under the Group Purchase Organization (GPO) scheme were implemented. In hindsight, despite the price cut, high-quality domestic players have continued to gain market share as a result of winning GPO bids.

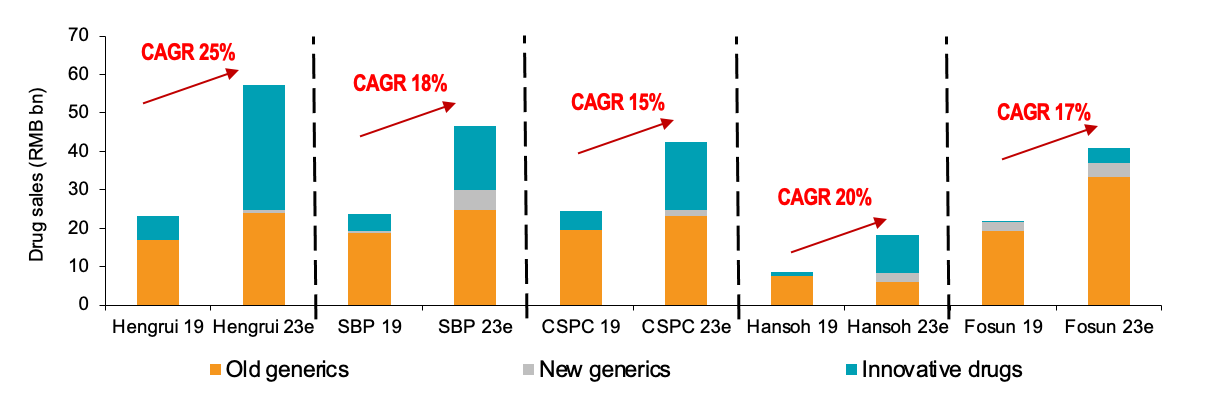

The case is further fostered by the Five Year Plan, which sets to encourage maiden research and development of innovative drugs to be sold and used domestically. By 2025, it is estimated that the market share of the top four domestic drug makers would reach 30% from the current single-digit level6.

Other than quality enhancement, innovation is a key to unlock the golden door to the true potential of China’s healthcare companies. This is in line with our preference of pharma companies in China – possessing strong innovation capability and rich pipelines, which shall make them fare better against the GPO hurts. In this space, we continue to favor the leading players that can maintain a visible cycle for drug and innovation discovery. As indicated in Figure 7, five leading pharma names on the mainland see a compound annual growth rate (CAGR) of double-digit in the next couple of years, mostly driven by innovative drugs. This confirms our unshaken views toward the sectors’ frontrunners.

Figure 7: Innovative drugs are the common driver of the leading pharma companies, enabling double digit CAGR in the forthcoming years.

Sources: National Medical Products Administration, Yaozhi, Company data, HSBC Qianhai Securities, June 2020

Source:

- CITIC Securities, February 2020

- CSCI Research, Frost and Sullivan, Morgan Stanley

- Ministry of education, July China State Council Information Office, May 2020

- Population Pyramid, Statistics bureaux of respective countries as of October 2019

- IBID

- IQVIA, Company data, CITI Research, 2019

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.