Value Partners Latest View: Japanese Yen and the Japan REITs market

03-05-2024

Ricky Tang, Head of Client Portfolio Management at Value Partners, shares his latest insights on the Japanese yen and the Japan REITs market:

Towards the end of April, the Japanese yen weakened to 160 against the US dollar, a level not seen since the 1980s. The weakness in JPY was driven by market expectations of a more hawkish Fed, as inflation remains much stickier than expected. The Bank of Japan (BoJ) is also believed to remain overall dovish, with the lack of details in its policy guidance following its recent meeting.

Given the increasing uncertainties around monetary policy and potential further FX intervention, the weakness in the Japanese yen is increasingly likely to see authorities intervene, and the currency is expected to remain volatile in the near term.

While we remain constructive on Japan’s equities market over the medium term, we also believe that near-term FX movement is likely to see some profit-taking from investors in the market. Amid rising volatility, we believe that diversifying into Japan REITs, rather than getting in and out from Japan assets, might be an interesting strategy for investors to consider.

Month-to-date in April, the Nikkei 225 index was down more than -6%, but the TSE Japan REITs index was up close to +1%, highlighting REITs’ defensive nature and diversification potential for investors to include in their portfolio.

Many investors are concerned that the exit of Yield Curve Control (YCC) and the potential interest rate hikes by the BoJ would hurt Japan REITs, as higher interest rates are likely to put pressure on the valuations of income assets like REITs.

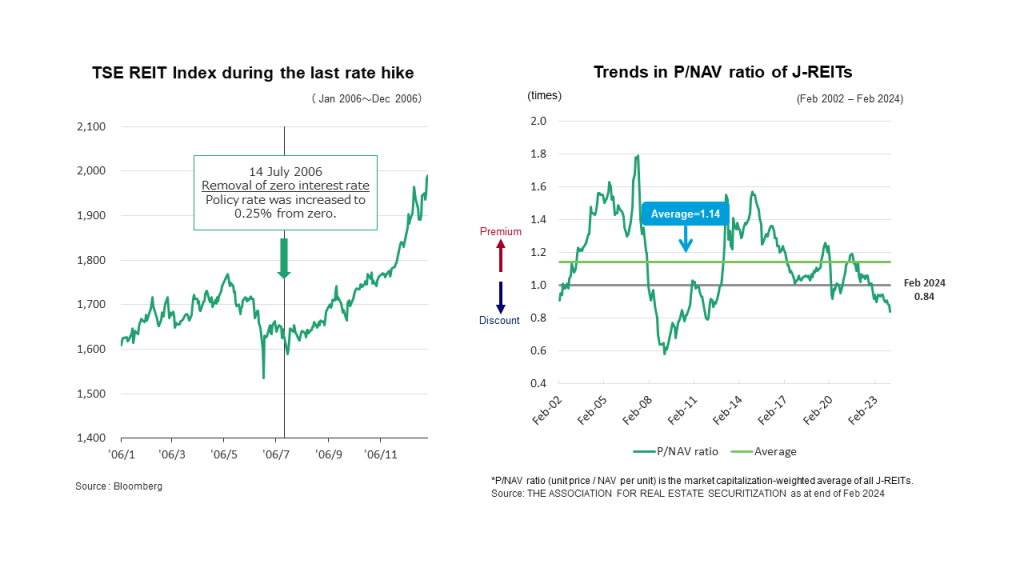

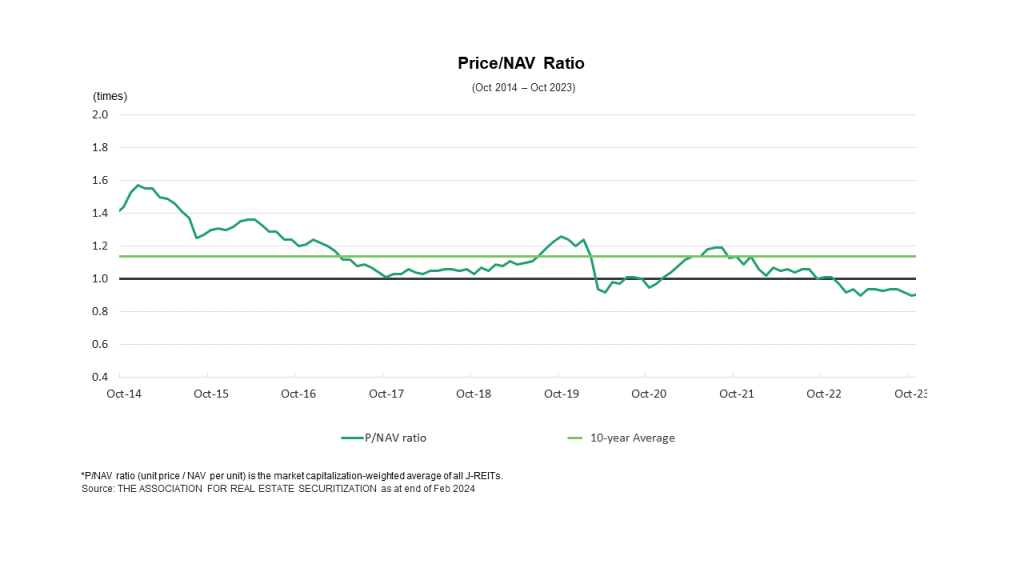

In fact, this is not entirely wrong – the Japan REITs market lost value earlier this year before BoJ announced the exit of YCC, before recovering its losses post-announcement. A key valuation measure for REITs, the Price/Net-Asset-Value (P/NAV), is now at a level of 0.8, which means that Japan REITs, in general, are trading at a discount, and the measure is also below the long-term historical average of 1.1x.

Currently, based on our analysis, the Japan REITs market has already priced upcoming interest rate hikes. Therefore, we expect the impact of the actual interest rate hikes to be very limited on the market.

In fact, historically, the Japan REITs market had delivered stronger results after actual interest rate hikes, as investors would prefer policy certainty. An example was in 2006, when the BoJ raised interest rates by 25bps. While Japan REITs generally fell briefly, they rose after the actual interest rate hikes. We believe that we might see a similar pattern as the BoJ hikes interest rates later this year, which means that it might be a good time to slowly diversify into the asset class now.

Japan REITs are also making efforts to improve shareholder returns amid the weak market environment, with more companies announcing share buybacks. Year-to-date, six J REITs have already announced share buybacks, compared with three in 2023.

Know more about Value Partners Japan REIT Fund

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This article has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.