Views on Chinese Market Turmoil

16-03-2022

Where do we stand on China’s volatile markets?

The increasing COVID infections in China and resulting lockdowns have further complicated the macro backdrop, leading to further corrections in the market. This is in addition to other risk factors that have led to market volatility, including the Russia-Ukraine tensions, rising commodity prices, and potential China ADR delistings.

Pandemic risks offer more visibility:

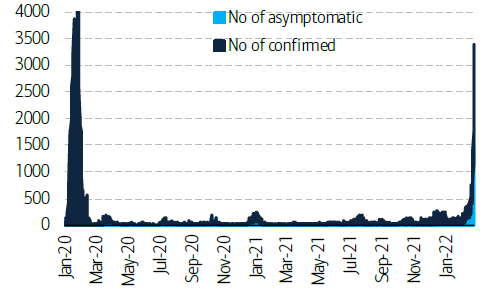

The spike of COVID infections in China has added to investor concerns, as the lockdowns are expected to affect supply chains in the near term. While the other risk factors, including the tensions between Russia and Ukraine and potential China ADR delistings, offer much less visibility in terms of their longevity and impact, the impact of the more recent lockdowns could be referenced back to 2020 during the first COVID outbreak. At the time, the market responded negatively at the beginning, but recovered fairly quickly and rallied in the next 6-12 months’ time:

Figure 1: Daily new confirmed and asymptomatic cases returned to previous levels in 2020

Number of confirmed + asymptomatic cases reached >3,000 on Mar 12th

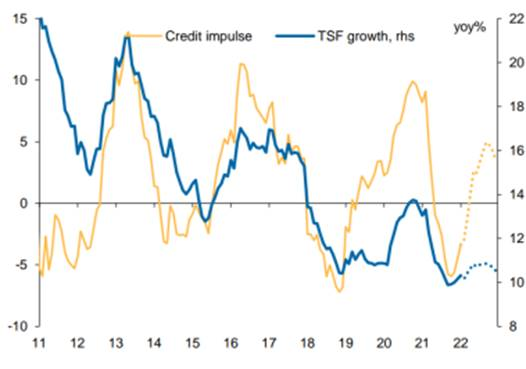

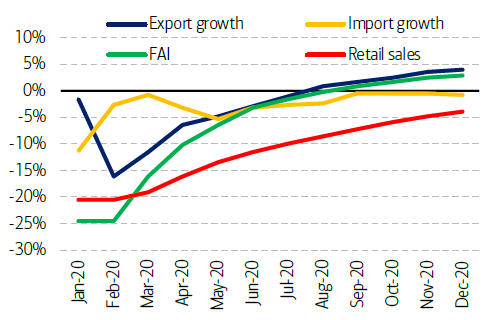

Figure 2: How China macro data recovered at a similar time in 2020

Source: CEIC, Wind, BofA Global Research

The next few weeks would be critical times to watch despite China having demonstrated its success in 2020 on containing pandemic risks with its strict controls and the zero-COVID strategy. If managed properly, China’s production activities, such as fixed asset investments and exports, shall recover quite quickly from the initial disruption and regain positive momentum.

Market view and outlook:

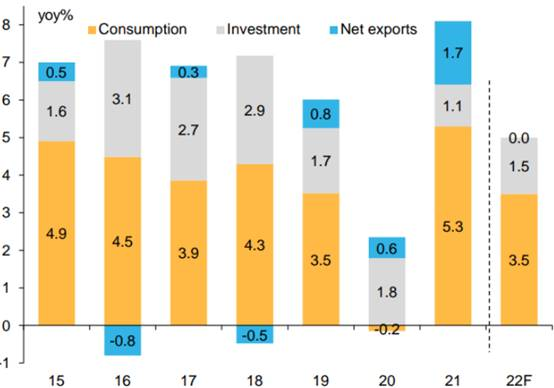

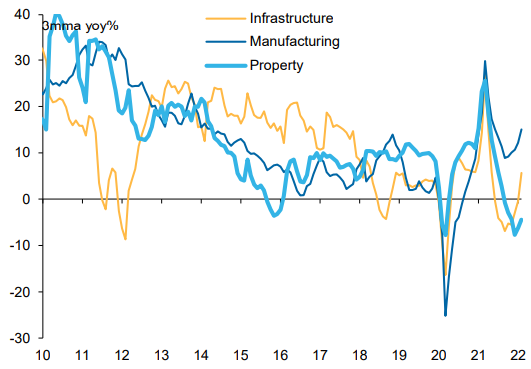

The key difference from 2020 is the government’s clear stance on easing since late-2021, which has been our focus on how China could yield better performance in 2022. Recently, the market perceived China’s 5.5% GDP growth target as “more aggressive than expected”. That said, we believe China policymakers are confident that this can be achieved as they rarely miss their targets from a historical perspective. In the wake of the recent market weakness, we expect that a further step up in easing is almost a must scenario from policymakers, especially March data is set to come in soft with the induced lockdowns. On policy easing, we have been discussing China has room to implement respective easing as:

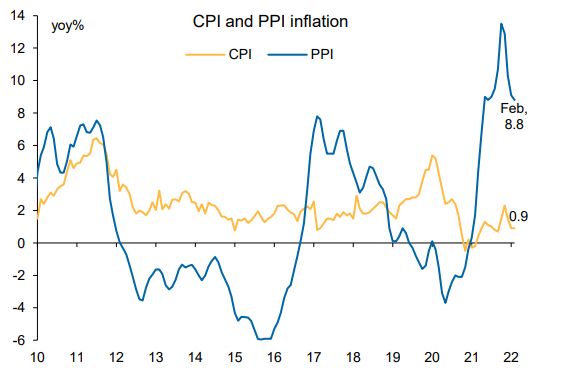

| Figure 3: Total Social Financing (TSF) YoY growth is bottoming out: | Figure 4: “Investment” as a component of GDP growth would expand if needed: |

| Figure 5: Investment growth is taking an upturn: | Figure 6: Inflation (CPI) remains low, implying that rate cuts are possible, contrary to the rest of the world: |

Source: Bloomberg, FactSet, NBS, WIND, IMF DOTS, Macquarie Macro Strategy, Macquarie Research, March 2022

The recent announcement that People’s Bank of China will transfer more than Rmb 1 trillion in profit to the central government, which will be used to fund tax reliefs and a rise in transfer payments to local governments, will also support the increase in fiscal spending as well as expand the monetary base.

Other risk factors:

In addition to pandemic risks, other uncertainties, including the Russia-Ukraine tensions and potential ADR delistings, have resulted in heightened volatility in markets.

With regard to the Russia-Ukraine tensions, the market is still pricing in this geopolitical uncertainty, with inflation being at the forefront of their concerns. With both Russia and Ukraine being major exporters of oil and other commodity products, coupled with ongoing developments on the various trade sanctions by the US and the European Union, the tensions may cause more bottlenecks in the supply chain and push up energy and food prices. That said, we view that China and Asia are in a better position than the rest of the world. Like China, inflation is also under control in other parts of Asia, including Taiwan and most of Southeast Asia. Most markets in Southeast Asia are also looking past the Omicron variant, as most have continued on their reopening, which should help the market catch up. We also believe that the tensions will have relatively less impact on the region compared to the west. While the tensions may further drive up inflation, this should benefit resource- and export-heavy Asia, especially Malaysia and Indonesia.

To read more about our views of how the tensions are impacting Asia and China markets, click here

Meanwhile, ADR delisting risks continue to impact the market. While the talk of potential ADR delisting is not new, tensions were heightened on 10 March as the HFCAA (Holding Foreign Companies Accountable Act) implementation began, with the SEC announcing 5 ADRs to be in the provisional list for the first time. The identified firms could be subject to delisting from U.S. exchanges if they fail to comply with the Holding Foreign Companies Accountable Act (HFCAA)’s auditing requirements for three consecutive years.

It is expected the selling pressure on Chinese ADRs to continue given the provisional list will keep growing on the back of SEC undertaking the assessment on a rolling basis during 2021 annual reporting season. In the near term, we expect volatility to continue as investors are sensitive to negative newsflow, which may cause overreaction. In terms of ADRs’ direct impact to our portfolios, they are minimal given our portfolios’ exposure to Chinese ADRs is minimal to none.

Overall, we view that volatility will remain high in the near term as the abovementioned risks have created many uncertainties, which triggered a market sell-off with investors not taking into consideration fundamentals and current valuations. We view that the medium- to long-term catalysts would focus on bottoming out sentiment, stepping up in easing and low valuations, which shall drive the mean reversal of the over-reacting share prices. Our portfolio approach remains unchanged and we continue to be more cautious in assessing our holdings’ vulnerability to these risks and how their fundamentals change amid the worsening sentiment.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions The information provided does not constitute investment advice and it should not be relied on as such All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed This material contains certain statements that may be deemed forward looking statements Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong Issuer Value Partners Hong Kong Limited.