When Powell turns to Volcker, you should turn to Value

22-09-2022

The Wall Street Journal recently reported that the US Federal Reserve Chairman Jerome Powell scrapped his original address at the Jackson Hole conference and instead delivered a brief remark with a strong message: The Fed is determined to bring inflation down and will “keep at it” until the job is done. His comment invokes “Keep At It,” the autobiography title of Paul Volcker, the former Fed chair who raised the Fed Funds rate to 20% at its peak to bring down inflation in the 80s, triggering a double-dip recession. Powell’s reference to Volcker and the experience in the 80s has brought fear to the market that the Fed will force ahead on aggressive tightening at the expense of triggering a recession. Following Powell’s speech, the US equities market fell by -7%, while short-term US Treasury yield reached new highs after 2008 to 4%.

Recession risk rises as Powell turns to Volcker

Clearly, the Fed last year underestimated how high inflation can rise. Now, it has become a high priority for Powell to fix the problem by bringing inflation back into control. As such, Powell’s intention was not to be seen as dovish when he mentioned in an FOMC press conference in July that the central bank could start slowing the pace of rate increases if inflation responds to the recent hikes. However, the market took that as a dovish signal for a potential Fed pivot, with the market rallying, taking some relief.

In our opinion, this misinterpretation by the market has made Powell even more determined to get his message across, reminding us of the then European Central Bank (ECB) chairman Mario Draghi’s “Whatever it takes” speech. In fact, we believe that the market is right this time in pricing in a more aggressive Fed. Powell’s strong commitment means it will take more substantial deterioration in economic data before the Fed even consider becoming milder in its guidance. Powell certainly does not want to be seen as not having enough determination to arrest inflation. This, in our view, increases the risk of pushing the economy into a recession.

A paradigm shift away from the last 15 years

Since the global financial crisis in 2008, the world has been awash with liquidity from zero interest rate policies and multiple rounds of quantitative easing, as inflation has never been an issue. In fact, many regions have had to deal with the problem of deflation, rather than inflation, for the last 15 years. Undoubtedly, globalization has played a significant role, as low labor costs from emerging markets and technological advancement helped control the cost of production.

Today, however, rising geopolitical tensions have stalled globalization, with companies and nations all starting to rethink their supply chains. We believe this has led to a structural paradigm shift, rather than a cyclical increase, in inflation dynamics. While year-on-year inflation is likely to come down in the next few quarters, deflation is unlikely to be something that central banks will have to worry about anymore, and the world is likely to see more frequent cyclical inflationary pressure. This has a profound implication on interest rates, as the probability of the world seeing negative interest rates and quantitative easing is approaching zero.

Value is back, not dead – but the key is Quality

With all the “free money” in the last 15 years, the concept of value investing has been out of fashion. As a style, it has underperformed the market by -47% since 2008. In contrast, growth as a style has outperformed 58%, especially in the last three years, super-charged by a huge amount of pandemic-related liquidity. However, with the comeback of inflation and orthodox monetary policy, some of the froth created over the last few years in areas like meme stocks, cryptocurrencies, non-fungible tokens (NFTs), and the like will need to face the harsh reality of rising interest rates. The process has already started: The market cap of cryptocurrencies has dropped below US$1 trillion from US$ 3 trillion in late 2021, while the average price of NFTs has declined by more than 90% to below US$300 from close to US$4,000.

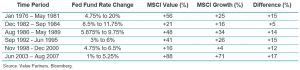

On the other hand, the return to “normal” monetary policy and cycle could lead to a comeback of value investing. The rising cost of capital means investors will demand a higher equity risk premium, typically favoring companies with overall lower valuations, better quality business profiles, and more sustainable cash flows. In fact, before 2008, value investing had outperformed in every period when interest rates were rising since 1975, including when Volcker raised Fed fund rates to 20%. The same has happened year-to-date, where MSCI Value has outperformed growth by 14% (to 19 Sep 2022).

That said, we believe that purely looking at valuations is not enough, as there are companies that are cheap for good reasons. Rather, quality companies with reasonable valuations, as opposed to companies having the lowest/cheapest valuations, are likely to provide investors with the best way to capture the opportunity in value investing. These quality companies typically have durable competitive advantages, which enable them to ride through challenging operating environments, and strong pricing power, which is especially important in the current environment of rising input costs.

History does not repeat, but it rhymes. If history is of any guidance for the future, and when one of the most important person (Powell) in setting monetary policy is turning to history (Volcker) for his guidance, it would be wise for investors to pay some attention to the winners of history.

This document is prepared for information purposes only. Any views and opinions expressed herein are subject to change without notice. It should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Information herein has been obtained from sources Value Partners Hong Kong Limited reasonably believes to be reliable, but no representation, or warranty, expressed or implied, is made as to the fairness, accuracy or completeness of the information. The contents of this document may not be reproduced or distributed in any manner without prior permission. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. Issuer: Value Partners Hong Kong Limited.