Important Information

| I. | Value Partners Classic Fund (The “Fund”) primarily invests in markets of the Asia-Pacific region, with a Greater China focus. |

| II. | The Fund invests in China-related companies and emerging markets which involve certain risks not typically associated with investment in more developed markets, such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. | |

| III. | The Fund is also subject to concentration risk due to its concentration in Asia-Pacific region, particularly China-related companies. The value of the Fund can be extremely volatile and could go down substantially within a short period of time. It is possible that the entire value of your investment could be lost. | |

| IV. | The Fund may also invest in derivatives which can involve material risks, e.g. counterparty default risk, insolvency or liquidity risk, and may expose the Fund to significant losses. | |

| V. | In respect of the distribution units for the Fund, the Manager currently intends to make monthly dividend distribution. However, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. | |

| VI. | You should not make investment decision on the basis of this material alone. Please read the explanatory memorandum for details and risk factors. |

Ranked No.1 in the

Greater China equity fund category1

(A Units)

Unlocking long-term and hidden

investment opportunities through a

proven and unique investment approach

A renowned Greater China expert

- The Fund aims to generate excess returns throughout different market cycles and hasconsistently outperformed peers1

- An award-winning investment team of over 60 financial specialists covering a wide range ofsectors and markets, with a combined average industry experience of 23 years

- Taps into undiscovered opportunities with a deep-dive investment research analysis combined with over 6,500 meetings annually

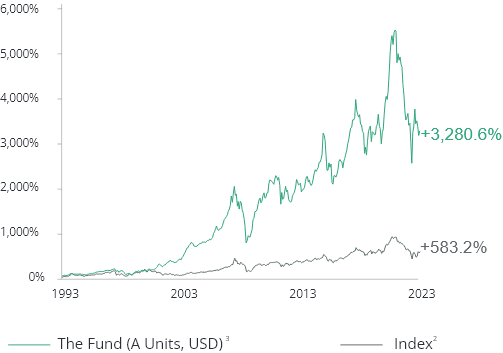

Outstanding performance since the Fund’s launch in 1993

Source: Morningstar and HSBC Institutional Trust Services (Asia) Limited as of 30 June 2023, in USD, NAV to NAV, with dividends reinvested. Performance data is net of all fees.

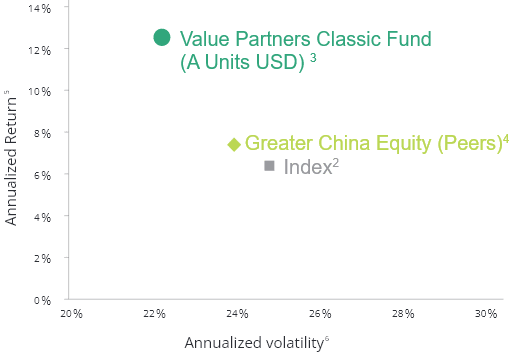

Provides better returns with lower volatility compared to peers

Source: Value Partners, Bloomberg and Morningstar as of 30 June 2023, performance in USD, net of all fees. All indices are for reference only.

Undemanding valuations for long-term investors

- China’s equities market will likely be supported by the government’s pro-growth, counter cyclical measures to boost the economy

- The MSCI Golden Dragon Index is still trading at an undemanding PE of 13.3x, slightly lower than its 10-year average of 14.8x

The China market is still trading below the average PE

Source: Bloomberg, data as of 30 June 2023

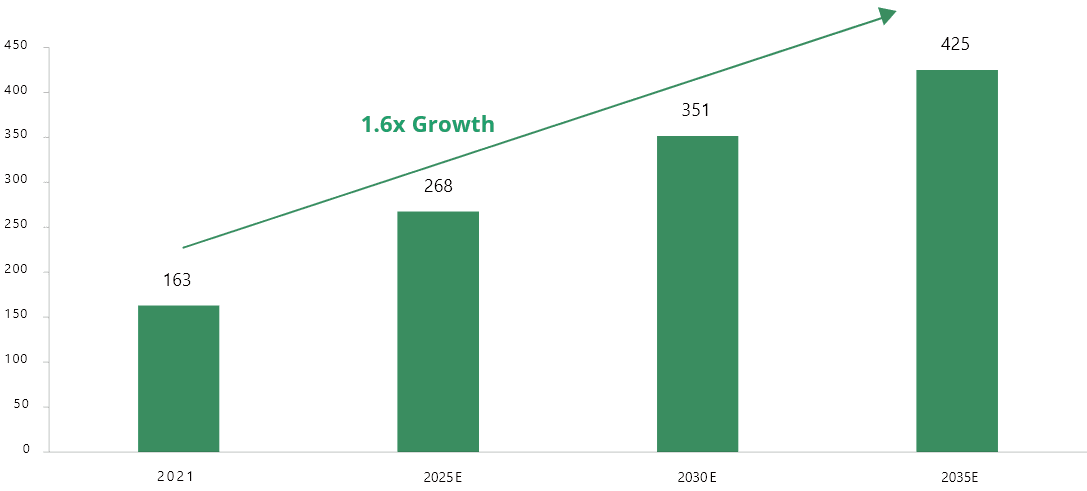

Consumption growth

- Consumption growth is likely to speed up with the economic recovery gathering momentums

- The rising middle-class population, increasing household income, and urbanization remain long-term growth drivers

- China’s middle-income population is expected to more than double by 2035, which is also more than the total population of the US

The number of Chinese adults with above USD250k wealth (million people)

Source: UNU-WIDER, World Income Inequality Database, World Bank, IMF, United Nations Population Division, HSBC Global Research, 2022

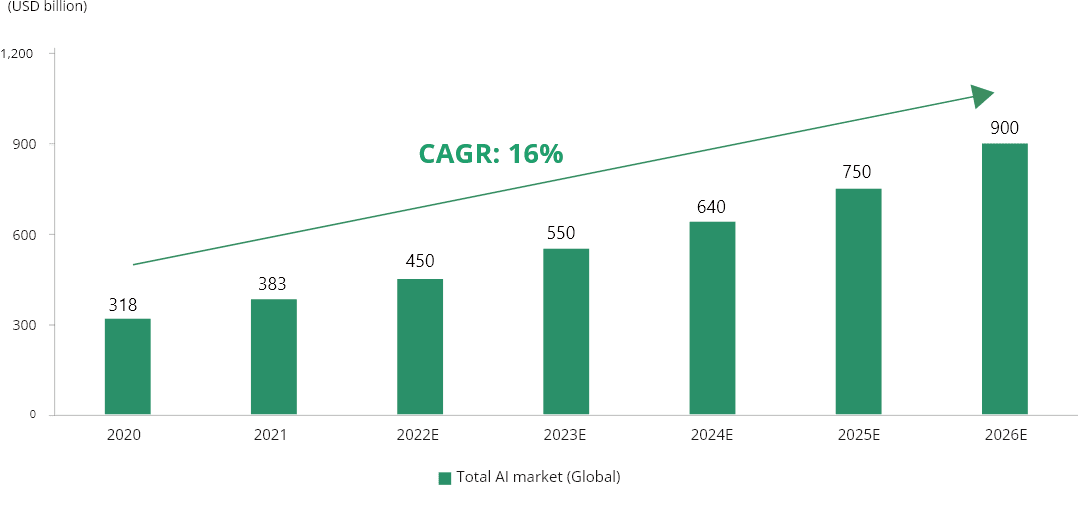

Technology leadership

- The demand for data centers and high-performance computing remains solid

- The accelerated investments into artificial intelligence (AI) are also new drivers, unlocking a new market that could reach USD900bn in 2026

- These support the growing demand for the leading technology players

The AI market is expected to grow rapidly (USD billion)

Source: BOFA Research, PwC, March 2022

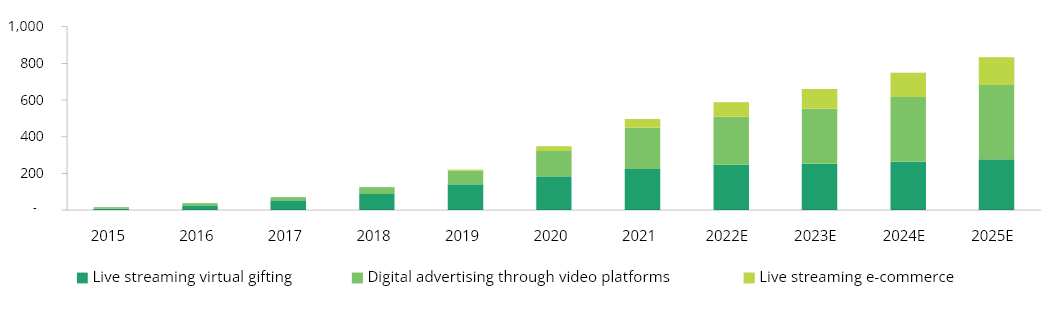

Internet Services

- Internet platforms are seeing a profit rebound on both cost optimization and business recovery, while the regulatory stance has turned to be supportive

- There are still plentiful growth opportunities in the internet space, such as in local services and short-form videos

Market scale of the short-form videos in China (RMB billion)

Source: iResearch, Macquarie Research, December 2022

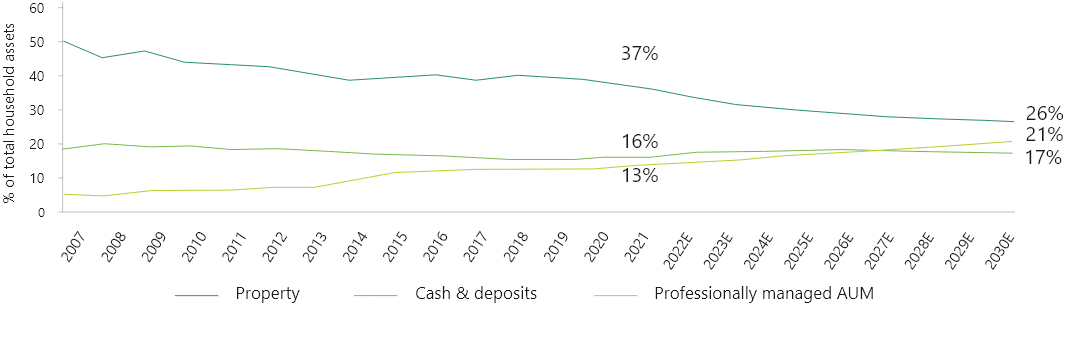

Financials – wealth management

- Wealth management service providers should benefit from retail investors’ growing demand for professionally managed investment services, presenting long-term investment opportunities

- The muted performance of the property market will encourage investors to diversify from property investment to financial assets over the long term

- Some leading retail banks, digital platforms, and insurance companies are well-positioned to capture this trend and grow their scale over time

Meanwhile, more assets are being reallocated from property towards financial products

Source: AMAC, CBIRC, CLSA, China Trustee Association, PBOC, WIND, 2022

Learn more about Value Partners Classic Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

1.Performance ranking is based on the performance of funds which are categorized under the Morningstar Greater China Equity Fund category and with performance history from 2 April 1993 to 30 June 2023.

2. Index refers to Hang Seng Index (Price Return) since fund inception till 31 Dec 2004, thereafter it is the Hang Seng Index (Total Return) up to 30 Sep 2017. Hang Seng Index (Total Return)includes dividend reinvestment whereas Hang Seng Index (Price Return) does not take into account reinvestment of dividends. With effect from 1 Oct 2017, it is the MSCI Golden Dragon Index (Total Net Return), which takes into account of dividend reinvestment after deduction of withholding tax.

3. The Fund (A Units) was launched on 1 April 1993. Calendar year return of A Units over past 5 years: 2018:-23.1%; 2019: 32.4%; 2020: 37.6%; 2021: -6.6%; 2022: -28.1%; 2023 (YTD): -2.5%. The Fund (C Units) was launched on 15 October 2009. Calendar return of the C Units over past 5 years: 2018:-23.5%; 2019: 31.9%; 2020: 36.8%; 2021: -7.2%; 2022: -28.4%; 2023 (YTD): -2.8%. Investors should note that figures for A Units shown above may differ from those of classes currently available for subscription (C Units), due to differences in launch date of these classes. For C Units, the since launch return is +84.8%. The Manager does not accept any application for A Units until further notice. New investors and existing unitholders who wish to top up may subscribe in C Units.

4. Category Average includes all funds with performance history started before 1 Apr 1993 in the category of Greater China Equity (offshore domiciled open-end funds). All funds in the Hong Kong Equity and China Equity categories (offshore domiciled open-end funds) with performance history started before April 1993 are shown as reference only.

5. Annualized return is calculated from inception based on published NAV.

6. Volatility is a measure of the theoretical risk in terms of standard deviation; in general, the lower the number, the less risky the investment, and vice versa.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed.

This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results.

Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed.

This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results.

Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.