Important Information

| I. | Value Partners High-Dividend Stocks Fund (The “Fund”) primarily invests in higher yielding debt and equity securities in the Asian region. |

| II. | The Fund may invest in higher-yielding debt and equity securities that are below investment grade. Such investments can involve greater risks due to the speculative nature. | |

| III. | The Fund may invest in China and other markets of the Asian region, therefore is subject to emerging market risks. Generally, investments in emerging markets are more volatile than investments in developed markets due to additional risks relating to political, social, economic and regulatory uncertainty. The value of the Fund can be extremely volatile and could go down substantially within a short period of time. It is possible that the entire value of your investment could be lost. | |

| IV. | The Fund may also invest in derivatives which can involve material risks, e.g. counterparty default risk, insolvency or liquidity risk, and may expose the Fund to significant losses. | |

| V. | In respect of the distribution units for the Fund, the Manager currently intends to make monthly dividend distribution. However, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. | |

| VI. | You should not make investment decision on the basis of this material alone. Please read the explanatory memorandum for details and risk factors. |

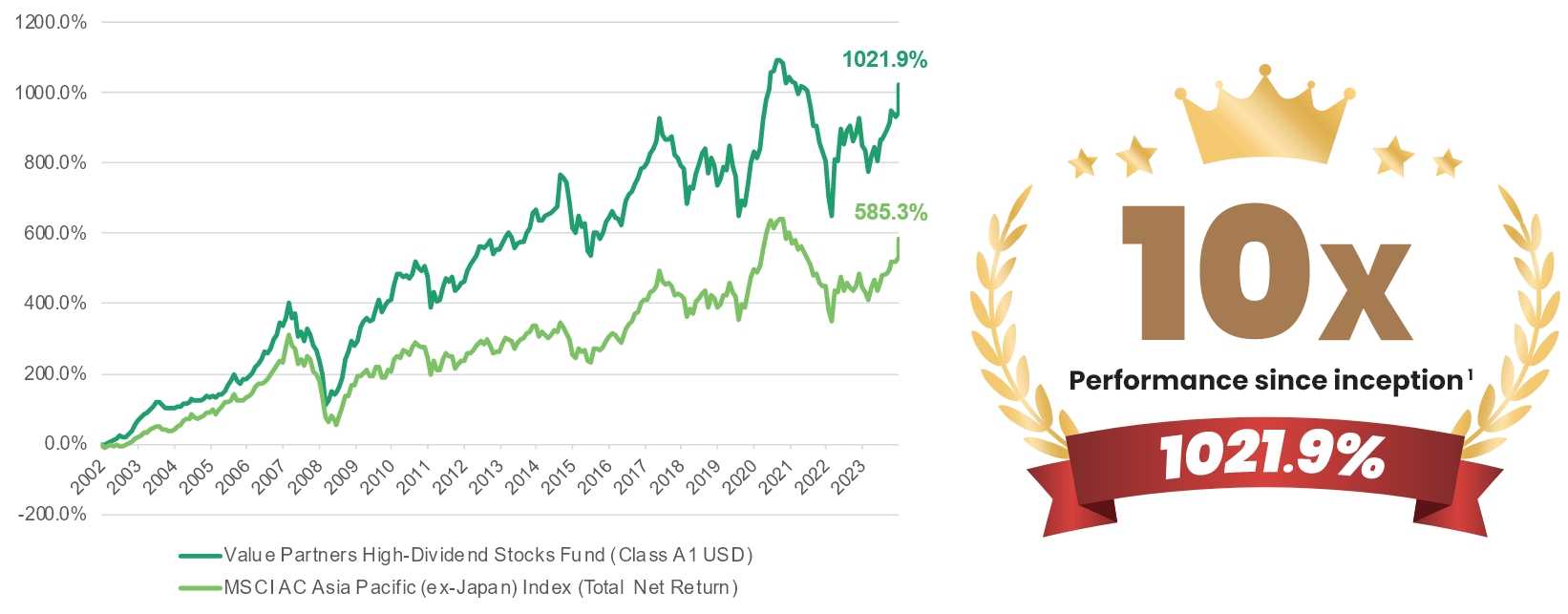

Achieved over 10x return since inception1

A proven flexible high-dividend equity strategy

that rides through

different market cycles

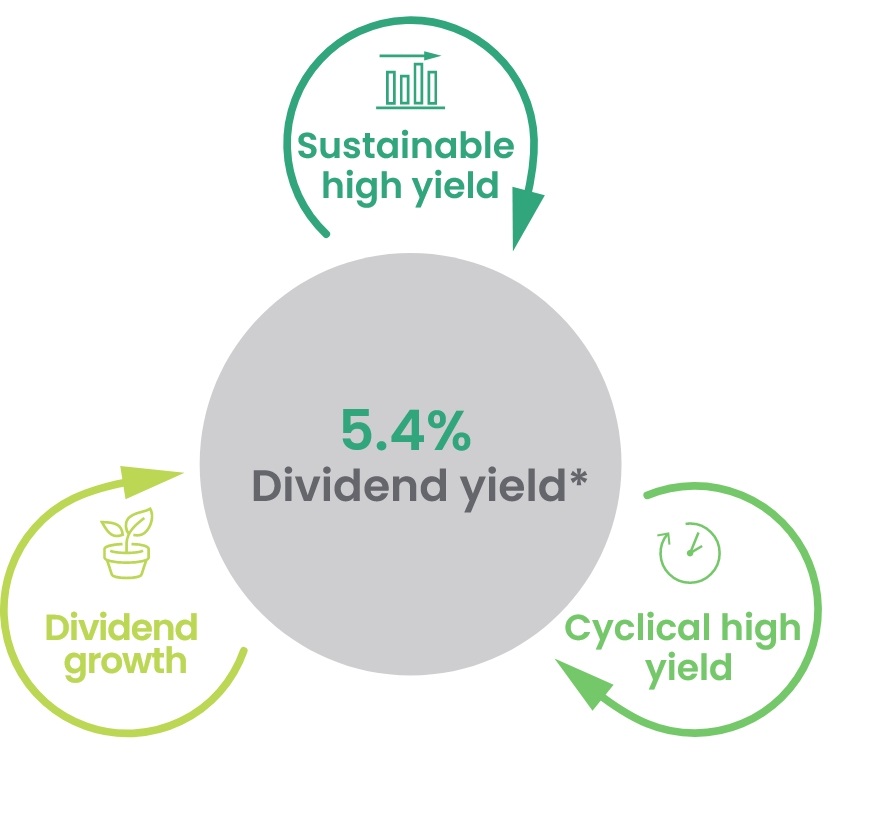

Targets to provide

monthly income: 5.4% p.a.2

(Dividend is not guaranteed and may be paid out of the capital. Please refer to Important Information V)

A proven flexible high-dividend equity strategy that rides through different market cycles

- Dividend income is a core return component when investing in Asia, with over 40% of the total return of Asian stocks coming from dividends since 2002

- The strategy focuses on companies with financial health, strong earnings growth, and stable cash flow, which can be translated into dividend and growth potential

- Focuses on bottom-up stock picking, which helps capture capital appreciation opportunities during potential market upturns: The fund achieved a return of over 10 times since its inception by the end of September 20241

Fund Performance since inception1 as of end September 2024

Source: Value Partners, HSBC Institutional Trust Services (Asia) Limited, as at 30 Sep 2024.

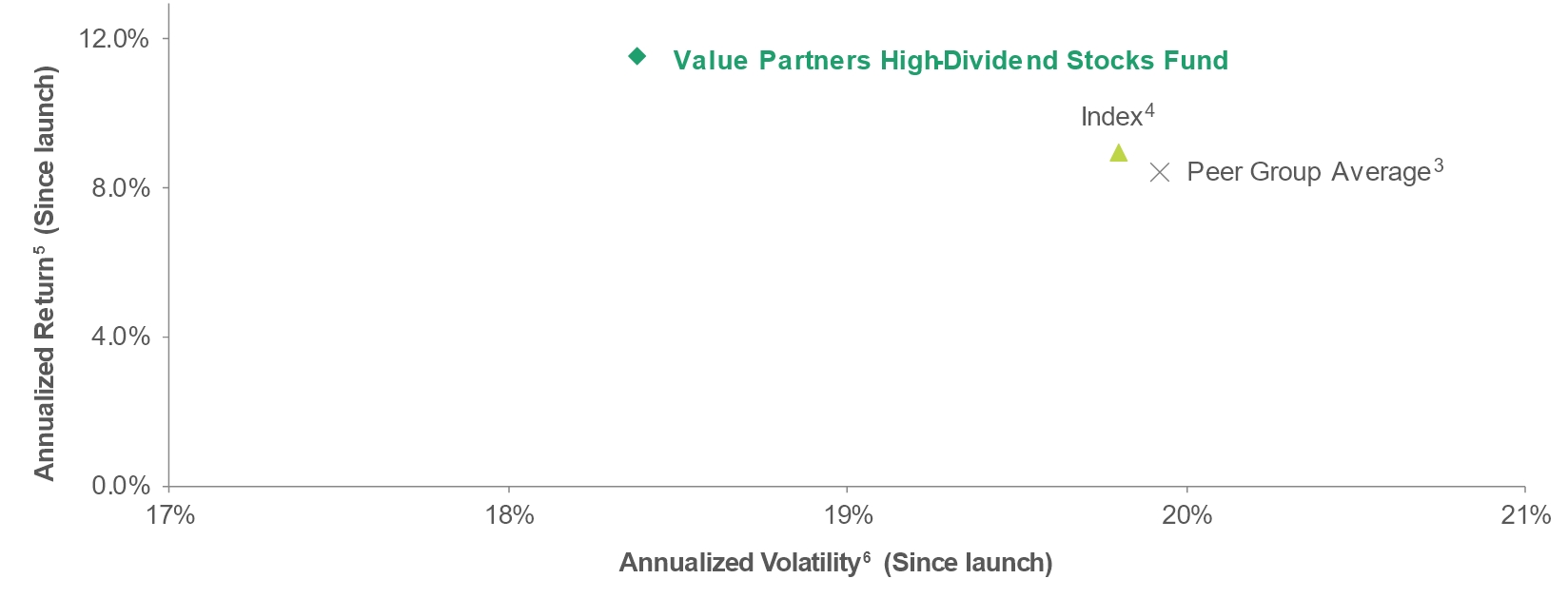

Asia high-dividend strategies are resilient

- Since its inception, the Fund has ranked first in the Asia ex-Japan equity fund category3, with its risk-adjusted return leading its peers and several indices

The Fund’s outperforming risk-reward profile

Source: Value Partners, as of 30 Sep 2024. Value Partners High-Dividend Stocks Fund (“the Fund”) (Class A1 USD) was launched on 2 September 2002. Fund performance is net of all fees. Calendar year return of Class A1 USD in the past five calendar years: 2019: 14.9%; 2020: 13.9%; 2021: 3.5%; 2022 : -18.9%; 2023: 4.1%; 2024 (YTD): +18.7%.

Targets to provide monthly income: 5.4% p.a.2

(Dividend is not guaranteed and may be paid out of the capital. Please refer to Important Information V)

(Dividend is not guaranteed and may be paid out of the capital. Please refer to Important Information V)

- Aims to provide sustainable income on a monthly basis2, the Fund allocates to Asian high-dividend stocks between sustainable and cyclical companies

- The Fund also strategically seeks investment opportunities and captures growth potentials, focusing on stocks with a visible growth trajectory over the next few years

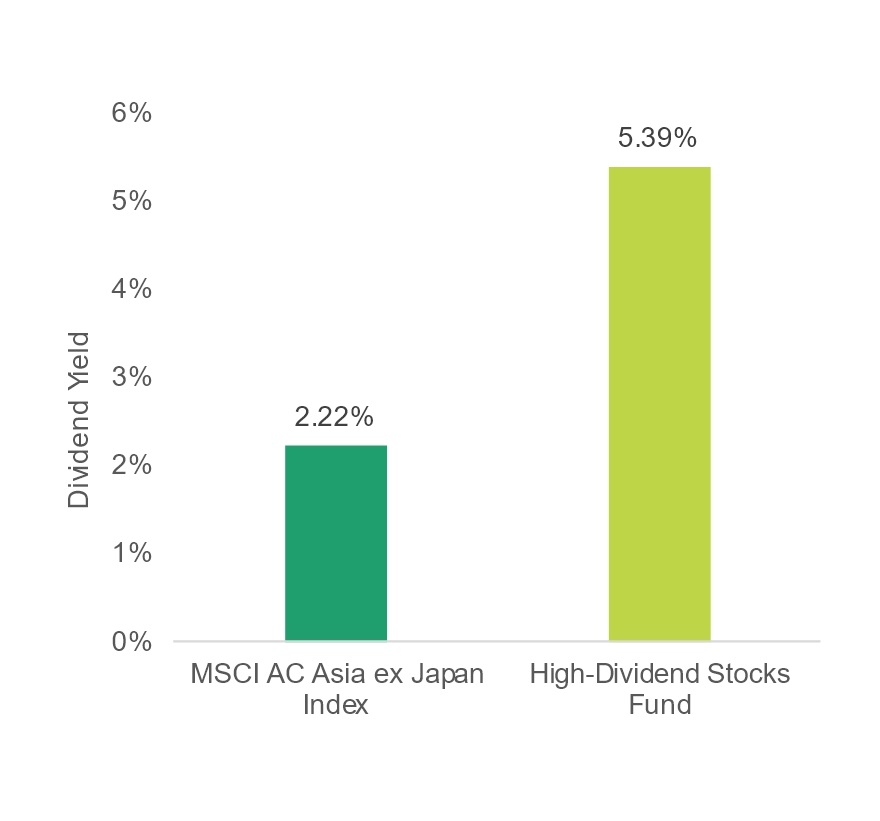

Providing a more attractive

yield than the market

yield than the market

*Source: Value Partners annual estimates, as at 30 Sep 2024

Source: MSCI, as at 30 Sep 2024

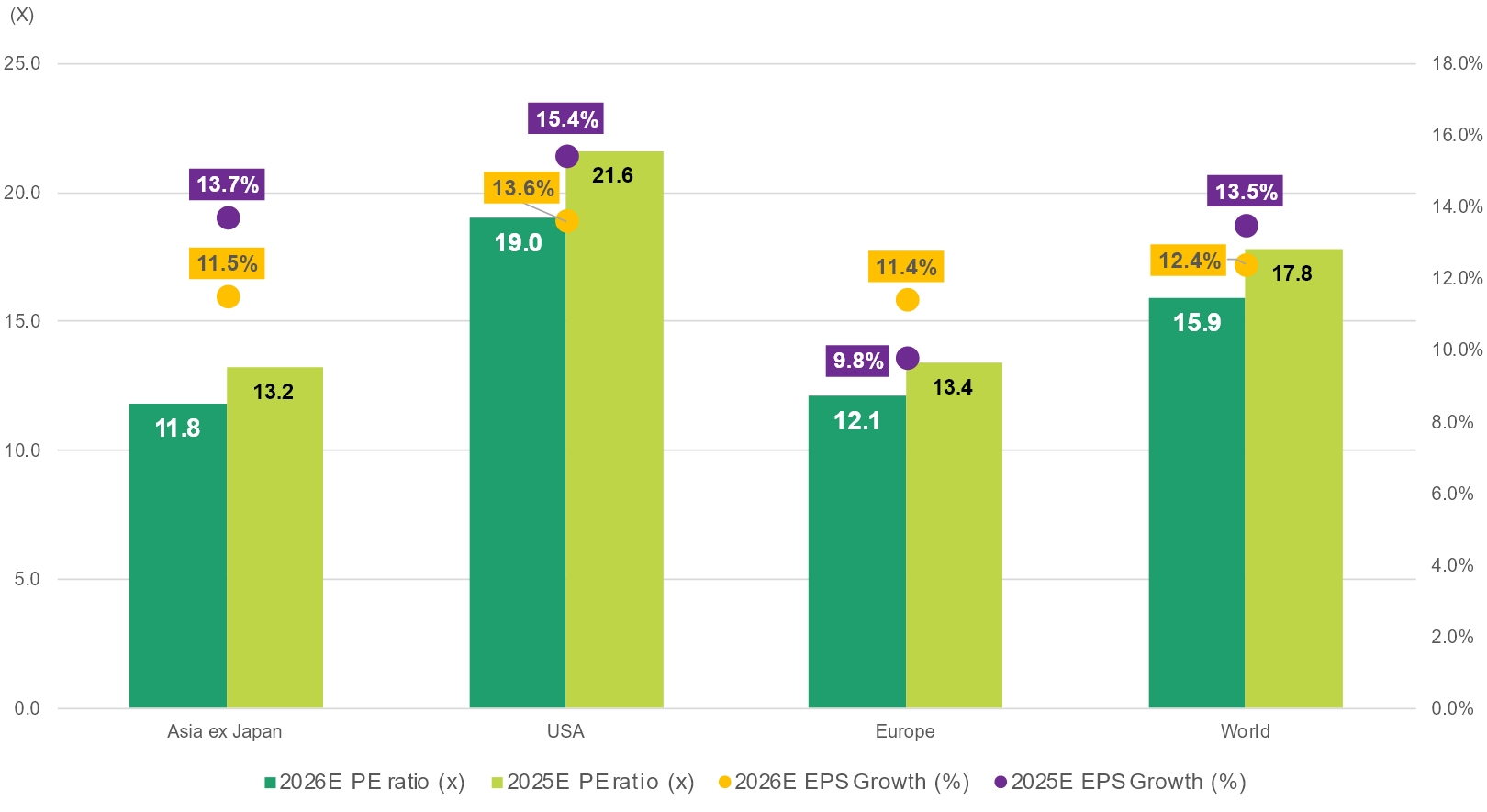

Undemanding valuations for long-term investors

- The dividend-focused strategy delivers a resilient performance under different market situations

- We believe the recent events reinforce the view that the “Fed put” is relevant. With the rate hike cycle coming to an end, companies that are trading at undemanding valuations with sustainable yields are more appealing

- Asia equities are trading at a discount to developed markets while maintaining decent earnings growth

Asia equities: undemanding valuations with decent earnings growth

Source: FactSet, I/B/E/S, MSCI, Goldman Sachs Global Investment Research, as at 20 Oct 2024

Learn more about Value Partners High-Dividend Stocks Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

All indices are for reference only. 1. Performance is calculated on NAV to NAV in USD with dividend reinvested and net of fees. Value Partners High- Dividend Stocks Fund (“the Fund”) (Class A1 USD) was launched on 2 September 2002. Calendar year return of Class A1 USD in the past five calendar years: 2019: 14.9%; 2020: 13.9%; 2021: 3.5%; 2022 : -18.9%; 2023: 4.1%; 2024 (YTD): +18.7%.

2. For Class A2 USD MDis as at 30 Sep 2024. Source: Value Partners. The manager intends to declare and pay monthly dividends equal to all or substantially all of the net income attributable to each of the Distribution Classes. However, there is neither a guarantee that such dividends will be made nor will there be a target level of dividend payout. No dividends will be paid with respect to the Accumulation Classes. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount that have been originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. Please refer to the Explanatory Memorandum for further details including the distribution policy. Annualized yield of MDis Class is calculated as follows: (Latest dividend amount/NAV as at ex-dividend date) x 12. Investors should note that yield figures are estimated and for reference only and do not represent the performance of the Fund, and that there is no guarantee as to the actual frequency and/or amount of dividend payments.

3. Peer Group Average based on Morningstar Category of Asia ex-Japan Equity (HKSFC) which includes all funds with performance history started between 2 September 2002 and 30 Sep 2024.

4. Index refers to MSCI AC Asia Pacific (ex-Japan) Index (Total Net Return) up to 30 April 2016, thereafter it is the MSCI AC Asia (ex-Japan) Index (Total Net Return) due to a change in investment profile. MSCI Total Net Return Indices takes into account of dividend reinvestment after deduction of withholding tax.

5. Annualized return and volatility are calculated from inception based on published NAV.

6. Volatility is a measure of the theoretical risk in terms of standard deviation; in general, the lower the number, the less risky the investment, and vice versa.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.